NVIDIA Earnings Preview: Grab rewards by guessing the opening price!

みんなさんこんにちは!

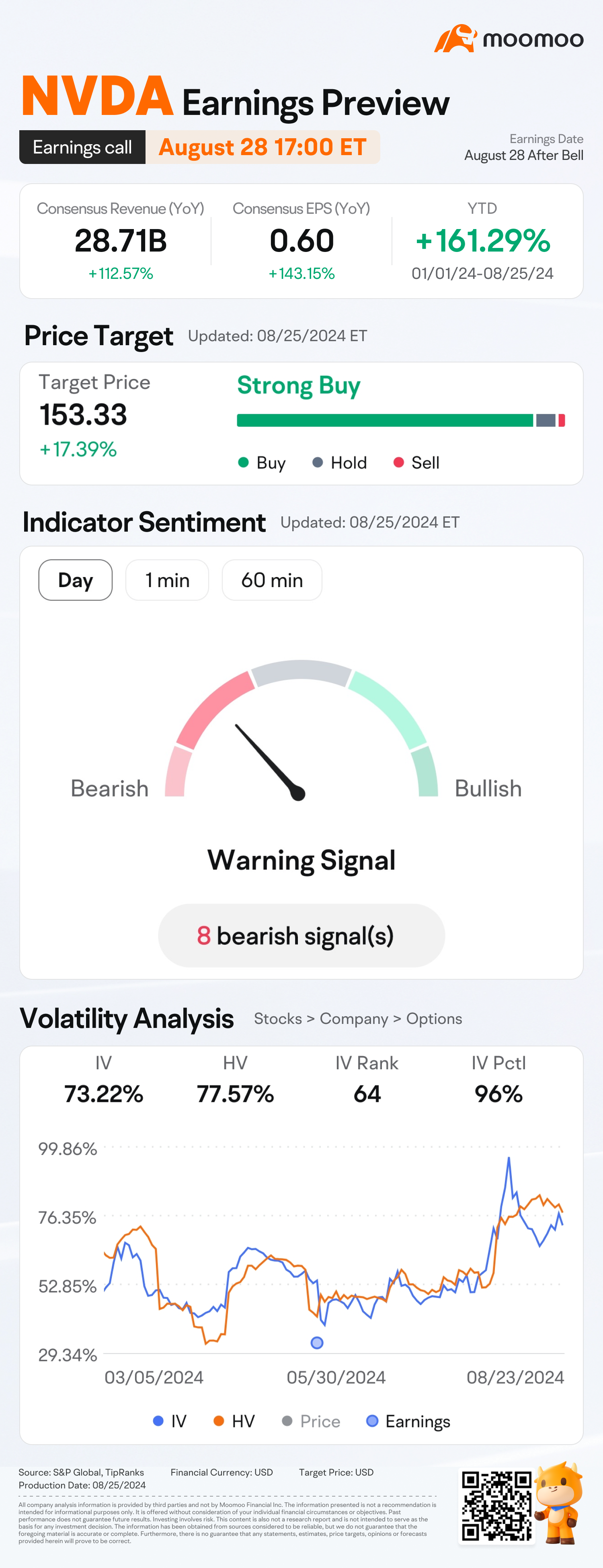

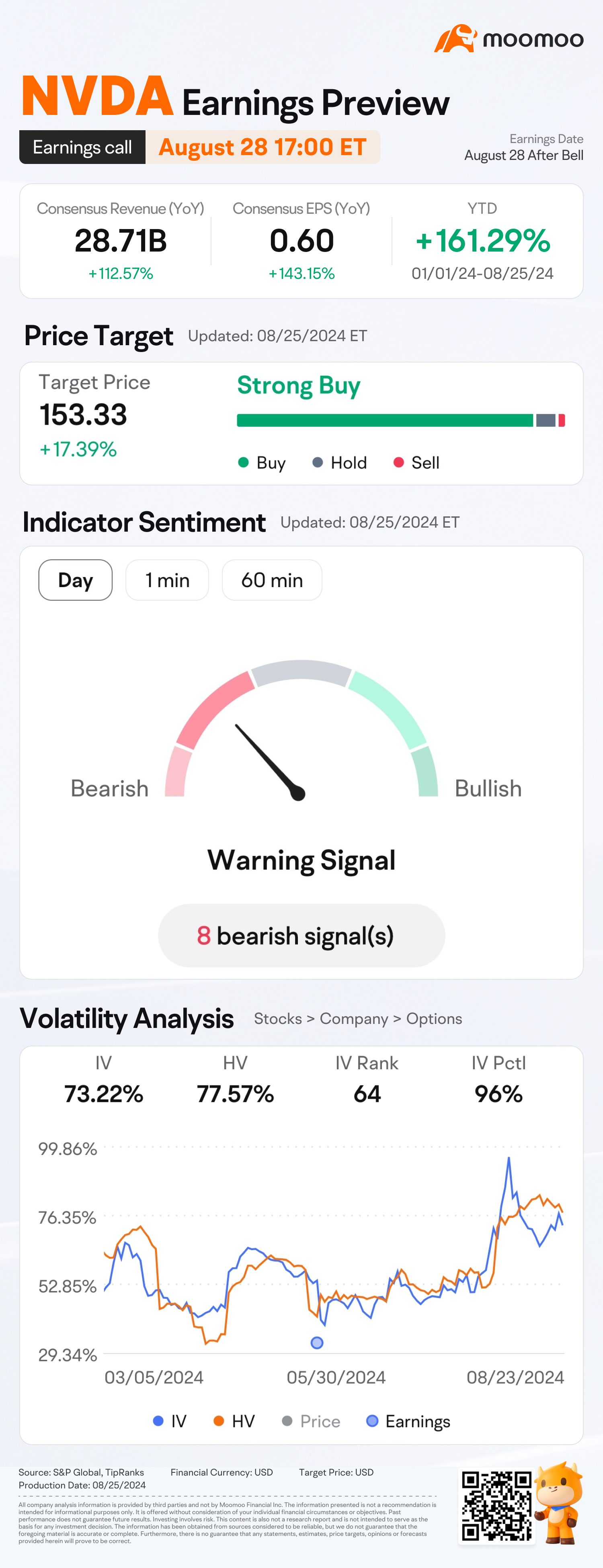

$エヌビディア (NVDA.US)$ is releasing its Q2 earnings on August 28 after the bell. Unlock insights with NVDA Earnings Hub>>

投資家は、Nvidiaの次期決算で2つの重要な点に注目するでしょう。需要の展開と、新製品Blackwellのリリースです。

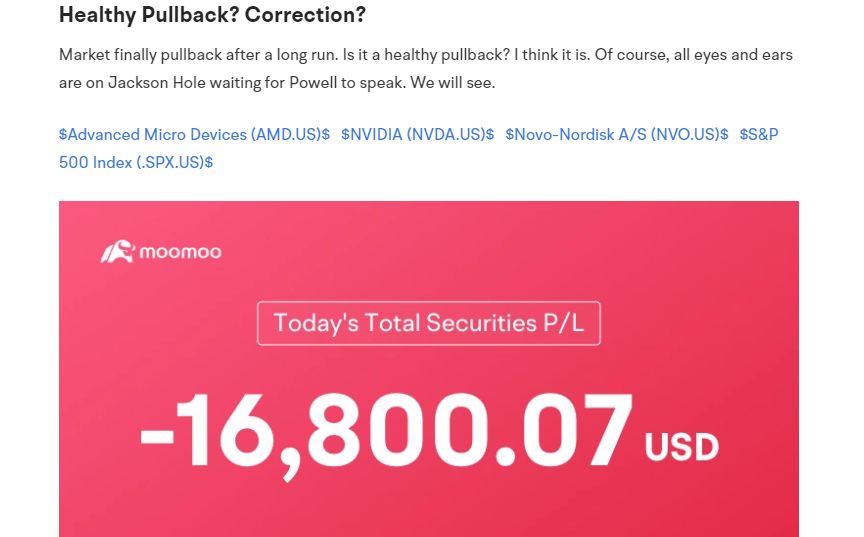

·Healthy Pullback? Correction?$140のNVDAと$270のTSLAの過去のピークを予測しました。現在NVDAは$130で再びピークに近づいています。

テクニカル分析に従っていくつかの電話をかけました - いくつかの指標からの警告信号を組み合わせることで価格動向の正確性を大幅に向上させました。ここには、現在のNVDA価格の '懸念を引き起こす' シグナルがいくつかあり、私はそれが非常に可能性の高いピークを指していると考えています。

市場は今後の結果にどのように反応するでしょうか? 今推測してください!

● 5,000ポイントの均等なシェア: 正しく推測したmooerたちへ のオープン価格の範囲で $エヌビディア (NVDA.US)$のオープン価格は 8月29日午前9:30時ET (例えば、50人のmooerが正解した場合、それぞれ100ポイントを獲得できます。)

(投票はエヌビディア8月29日午前6:00に締め切られます)

注意:

1. リワードは結果発表後5-7営業日以内に配布されます。

3. 選択は、投稿の品質、独創性、およびユーザーエンゲージメントに基づいています。

3.人気、オリジナリティ、エンゲージメントに基づく投稿の選択結果です。

1. リワードは結果発表後5-7営業日以内に配布されます。

3. 選択は、投稿の品質、独創性、およびユーザーエンゲージメントに基づいています。

3.人気、オリジナリティ、エンゲージメントに基づく投稿の選択結果です。

免責事項:このプレゼンテーションは情報および教育目的のみであり、特定の投資または投資戦略の推奨または支持ではありません。投資をする前に、ライセンスを持つ専門家に相談してください。詳細については、こちらの link 詳細については その他 をご覧ください。

免責事項:このコンテンツは、Moomoo Technologies Incが情報交換及び教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする

102362254 : I guess Nvidia may open between 130-138 on August 29. Analysts are optimistic about significant earnings growth, expecting an increase in EPS, largely due to growing demand for its AI GPU chips. Nvidia aims to showcase the profitability of its AI chips with ROI metrics, addressing investor concerns about AI investments. The upcoming Blackwell GPU chips are expected to drive revenue growth in late fiscal 2024 and early fiscal 2025. Also, Goldman Sachs' confidence in Nvidia's earnings potential has led to upward revisions in EPS estimates. Nvidia has good technical ratings, likely to continue its growth trajectory, driven by its advancements in AI technology and strong market demand.

mr_cashcow : Oops seems like a dud, revising price to 122~130![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Let's dive in & take a closer look

Potential bullish signals:

▲Gaming segment growth: Nvidia's gaming business is expected to remain strong, driven by the popularity of its GeForce GPUs and the growing gaming market with many hardcore gamers needing to upgrade their rigs every year will contribute to earnings

▲Datacenter expansion: Nvidia's datacenter business is likely to continue growing, fueled by increasing demand for AI, cloud computing and high-performance computing. There was also a showcasing of the latest cooling setup of Maxwell servers which looks very cool

▲AI and autonomous vehicles: Nvidia's investments in AI and autonomous vehicles may start to bear fruit, contributing to revenue growth

Potential roadblocks & speed bumps ahead:

▼Global economic uncertainty: Economic slowdowns or recessions in key markets may impact Nvidia's revenue

▼Competition: Intensifying competition in the GPU market from AMD and Intel may pressure Nvidia's market share and pricing

▼Supply chain constraints: Ongoing supply chain issues may affect Nvidia's ability to meet demand and maintain profitability

Earnings expectations is definitely overwhelmingly positive and beating expectations

Disclaimer: All the above are purely for educational purposes and are NOT financial advice, plz DYOR/DD

ZnWC : Thanks for the event![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Here's my analysis:

Positive

1) Expected to report adjusted EPS of $0.65 on revenue of $28.7 billion. That works out to a 139% jump in EPS and a 113% increase in revenue YoY.

2) Nvidia is the world leader in AI chip design and software, controlling between 80% and 95% of the market.

3) Data center business is expected to bring in $24 billion in revenue, a 142% increase YoY

Negative

4) Concerned that a pullback is coming. Nvidia stock is up more than 163% year to date and 60% in the last six months.

5) Rivals chip maker like AMD announced a 5 billion acquisition of ZT Systems to boost its GPU sales last week. Nvidia stock lost 2% on the next trading day.

6) Uncertainty in Fed rate cutting amid oil price increasing and US recession risk.

My bet is that the Nvidia share price will rise after the earnings call.

Wonder : My guess is Nvidia will beat n exceed expectations, but share price may fall as the results/guidance may fall short of the super high standards already priced in.

stevenlsf1 : It will be very difficult to meet expectations this time

leeloohui : 好

天空1612 : above 138!

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Triston Chua :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

LIM 104079753 : 希望可以过135 吧!看好他.....

飞吧

もっとコメントを見る...