The biggest macro event of the week happens Saturday.

Here is what you need to know about the Chinese ''fiscal'' press conference:

Chinese policymakers are applying a Western-like playbook here.

Lift the stock market at all costs.

And hope that's enough to loosen financial conditions and rescue the Chinese economy.

But there is a problem with that.

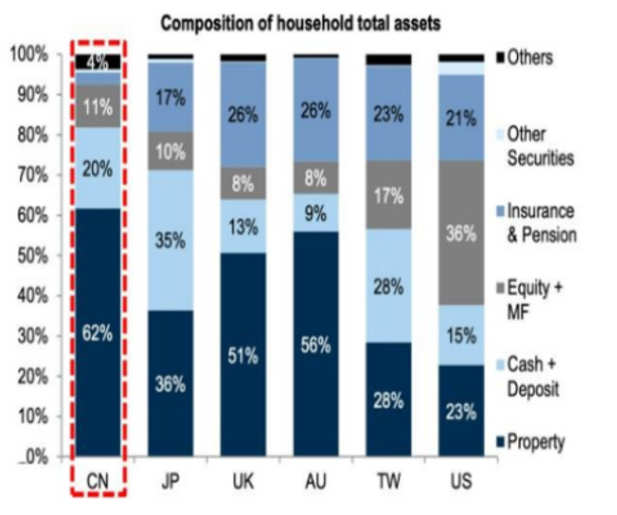

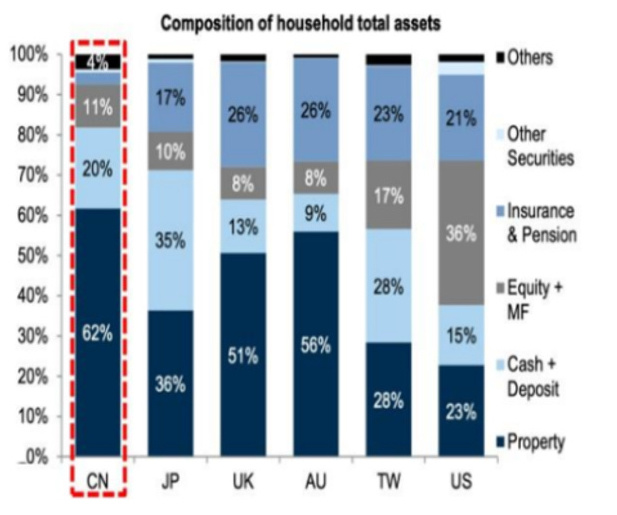

Contrary to Western societies, Chinese households have most of their wealth stored in the housing market - not in the stock market.

The Chinese economy needs some true stimulus.

And Saturday we will hear whether policymakers are serious about that or not.

Chinese policymakers are applying a Western-like playbook here.

Lift the stock market at all costs.

And hope that's enough to loosen financial conditions and rescue the Chinese economy.

But there is a problem with that.

Contrary to Western societies, Chinese households have most of their wealth stored in the housing market - not in the stock market.

The Chinese economy needs some true stimulus.

And Saturday we will hear whether policymakers are serious about that or not.

Fiscal is the only solution left.

Credit creation has been exhausted: corporates were fully tapped (phase 1) in 2016 already, and households are also fully tapped now (phase 2).

New money creation can only come from the government via fiscal deficits.

Credit creation has been exhausted: corporates were fully tapped (phase 1) in 2016 already, and households are also fully tapped now (phase 2).

New money creation can only come from the government via fiscal deficits.

But how much is needed?

Banks point towards a 3-5 trillion Yuan package (~500bn USD).

That would be decent, but a true Chinese fiscal bazooka will look more like 7-8 trillion Yuan (~1 trillion USD).

In 2008-2010 China went for a real money-printing bazooka, and the 2-year cumulative change in money creation was around +50% in real terms.

That was the equivalent of 20 (!) trillion Yuan printed in 2 years.

7-8 trillion Yuan would be a solid start.

Banks point towards a 3-5 trillion Yuan package (~500bn USD).

That would be decent, but a true Chinese fiscal bazooka will look more like 7-8 trillion Yuan (~1 trillion USD).

In 2008-2010 China went for a real money-printing bazooka, and the 2-year cumulative change in money creation was around +50% in real terms.

That was the equivalent of 20 (!) trillion Yuan printed in 2 years.

7-8 trillion Yuan would be a solid start.

China urgently needs some large, targeted fiscal stimulus.

Anything less than 3-4 trillion Yuan will be taken negatively from markets over the medium run.

Anything less than 3-4 trillion Yuan will be taken negatively from markets over the medium run.

免責事項:このコミュニティは、Moomoo Technologies Inc.が教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする