BoC | Moomoo Researchによる50bp利下げ後の投資戦略の機会を開く

カナダ銀行は3.75%に基準金利を50ベーシスポイント引き下げると発表し、6月の最初の引き下げ以来、4回連続の利下げを記録した。 50ベーシスポイントの大幅な引き下げは、9月のインフレ率データが1.6%に低下し、カナダにおける経済的な低迷リスクを反映しているため、主にそうである。 カナダ銀行の目標は、インフレ率を2%前後に維持し、国内の経済成長を促進することです。

第3四半期にカナダの経済成長が鈍化し続け、供給過剰の状況に直面しており、生産された商品とサービスに対する需要が不足しており、依然として労働市場が弱い状況で、人口増加が雇用増加を上回っている。 したがって、カナダ銀行は金利を引き続き引き下げると予想される。このカナダ銀行による引き下げの期待を考慮すると、投資戦略をどのように調整すべきか?

1. 債券ETFと高配当株ETFへの投資を優先し、高いリターンを確保

利下げ環境では、新しく発行される債券は低金利を提供し、既存の債券の相対的な価値が向上し、債券価格を押し上げます。 債券ETFは、債券バスケットへの投資を便利に提供し、債券価格の上昇から利益を得る可能性があります。 一方、預金金利と債券利回りが低下すると、高配当株が提供する比較的高い利回りがより魅力的になります。

1.債券ETF:

VSCは、カナダのクレジットボンド指数のパフォーマンスを再現することを目的としたパッシブに運用されるインデックスファンドです。このETFは主に、カナダの投資適格法人向けの短期投資適格社債に投資し、インデックスサンプリング戦略を用いて運用されています。このETFの目標は、そのベンチマーク指数であるブルームバーグ グローバル アグリゲート カナダ 1-5年 クレジットボンド指数のパフォーマンスを可能な限り正確に追跡することです。この戦略により、ETFは主要なリスク要因やその他の主要な特性に基づいてポートフォリオを調整しています。

さらに、VSCはわずか0.11%という低い運用手数料を持ち、カナダの短期投資適格法人向けの社債市場において理想的な選択肢です。2024年6月5日以来、VSCは2.26%上昇しました。2024年10月24日現在、VSCの資産は92100万カナダドルに達し、配当利回りは3.45%です。

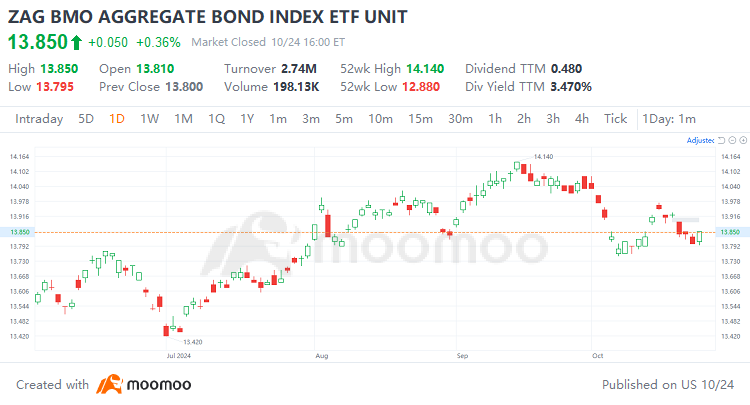

(2)第二提案-株主総会の議決に基づき、普通株式の総数を0.001ドルの1株当たり17.5億株(17.5億株)から50億株(5000万株)に増やす提案を修正します。 $BMO AGGREGATE BOND INDEX ETF CAD UNITS (ZAG.CA)$

ZAGは、カナダの投資適格固定金利市場内のさまざまな債務証券に主に投資するトロント証券取引所(TSX)に上場されたETFです。これらの証券には、1年以上の満期を持つ連邦、州、法人債が含まれます。カナダの投資適格固定金利市場に参加する比較的低コストかつ多様化された方法を提供し、その過去のリターンはいくぶん不安定であったが、全体的なパフォーマンスは堅調です。

さらに、ZAGは比較的低い0.09%の運用費用率を持っています。2024年6月5日以来、ZAGは1.54%上昇しました。2024年10月24日現在、このETFの資産は101.42億カナダドルに達し、配当利回りは3.47%です。

2.高配当ETF:

このETFはFTSE Canada High Dividend Yield Indexを追跡しています。現在、世界市場から56銘柄の高配当株を保有しており、主に金融(主に銀行に焦点を当てて)およびエネルギーセクターに集中しており、総保有額の80%以上を占めています。銀行業界に対する金利の低下の直接的な影響は、預金への金利費用の削減であり、これは全体的にプラスの効果をもたらします。一方、エネルギー企業は産業の性質上、マクロ経済状況の影響を受けにくく、安定した運営状況を維持し、株主に資本還元を進んで行っています。したがって、VDYは中央銀行の金利引き下げ戦略から恩恵を受けると予想されています。

VDYの運用費用率は0.20%で、2024年6月5日以来11.86%上昇しています。2024年6月5日以来、このETFは過去5年間で43.69%増加し、現在の配当利回りは4.32%です。

VDYに類似して、XDIVも大規模な時価総額を持ち、品質、配当利回り、成長を組み合わせた高品質の製品です。カナダ市場の約30の高配当株を含み、運用チームがポートフォリオを継続的に調整しています。高配当カナダ株のための低コストポートフォリオとして機能し、手数料はたったの0.10%で、10の製品の中で最も低く、コストを重視する投資家にとって優れた選択肢です。XDIVは、安定した財務状況を持つ企業、安定した財務状況と収益の波動が少ない企業を主に選択しています。

XDIVの運用経費率は0.10%です。2024年6月5日以来、XDIVは11.60%上昇しています。2024年10月24日時点で、このETFは過去5年間で39.19%上昇し、現在の配当利回りは4.05%です。

このETFはS&P/TSX Composite High Dividend Indexを追跡し、現在75の株式を保有しており、主にエネルギーセクターに集中しています。上位10の保有分はそれぞれ約5%を占め、前述の2つの製品と比較してXEIのポートフォリオはより多様化しており、個々の株式の影響を受けにくいです。これにより、リスク分散が高まります。

XEIの運用経費率は0.20%です。2024年6月5日以来、XEIは9.56%上昇しています。2024年10月24日時点で、このETFは過去5年間で30.89%上昇し、現在の配当利回りは4.54%です。このETFは、安定した多様化された投資ポートフォリオを目指しており、金利が低下し市場の波乱が生じた際にも、様々な局面で長期的な安定した収益を達成することが期待されています。

2.インタレートカットが不動産セクターに好影響をもたらすことが期待されています:reitおよび関連etfに焦点を当てる

カナダ銀行の金利引き下げにより、ローン金利がさらに低下し、不動産セクターの財務負担を軽減し、業界の拡大を可能にする可能性があります。同時に、低金利によって借り手や住宅購入者の財政負担が軽減されることが期待されています。低いローン金利は不動産市場の魅力を高め、市場取引の増加を促進します。さらに、金利引き下げに続く適度な経済回復により、小売業や産業用不動産市場が安定化する可能性があります。

全体として、金利引き下げは不動産市場の回復を促進するのに有益です。カナダ銀行による6月5日の最初の金利引き下げ以来、S&P/TSXコンポジット不動産(セクター)インデックスは17.77%以上上昇し、一般的なS&P/TSXコンポジットインデックスの10.87%増を大幅に上回っています。

1. reit:

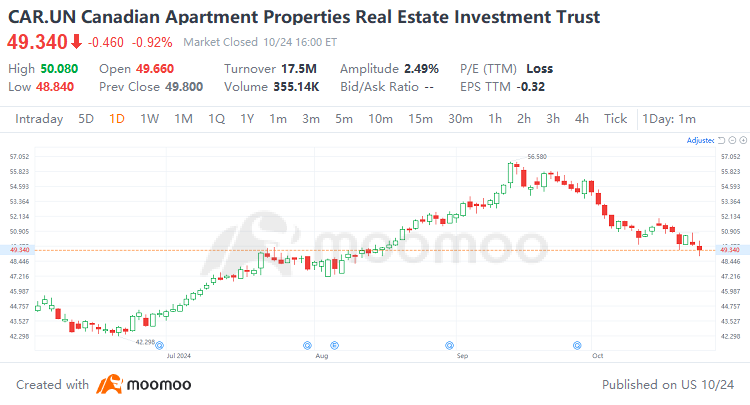

Canadian Apartment Properties REIT(CAPREIT)は、主にカナダの主要都市圏に位置する多ユニット居住用賃貸物件を取得およびリースする不動産投資信託です。そのポートフォリオは主に公共施設の近くに位置するアパートやタウンハウスで構成されており、中級から高級市場セグメントをターゲットとしています。

2024年10月24日現在、CARは総時価総額CAD 82.48億を誇り、配当利回りは2.94%で、カナダの現行無リスクレートよりも低いです。2024年6月5日以来、CARは9.00%上昇しています。同社は月額配当を支払い、最新の配当は1株あたりCAD 1.50であり、良好かつ安定した配当支払いを維持しています。

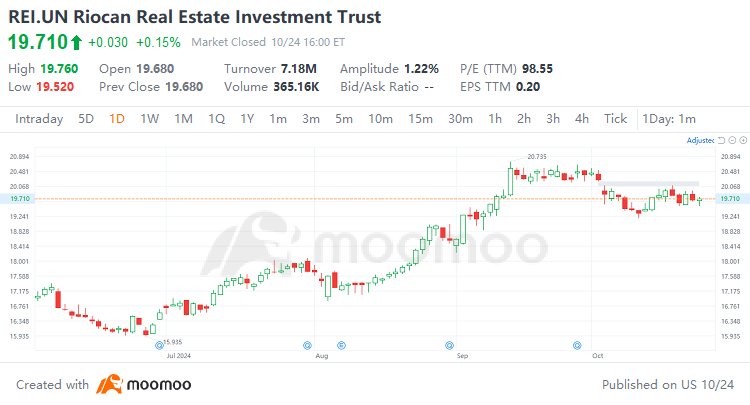

RioCan不動産投資信託は、ショッピングセンターおよび複合開発プロジェクトを含む小売中心の不動産ポートフォリオを所有し、開発し、運営するカナダの不動産投資信託です。主な物件はカナダのオンタリオ州にあり、リオカンのテナントには食料品店、スーパーマーケット、レストラン、シネマ、薬局、企業が含まれています。

2024年10月24日現在、REIは総時価総額CAD 59.12億を有し、配当利回りは5.55%で、カナダのリスクフリーレートを上回っています。2024年6月5日以来、REIは14.47%上昇しています。同社は年間12回の配当支払い頻度を維持し、最新の配当は1株あたりCAD 1.11であり、2021年以降安定した上昇トレンドを示しています。

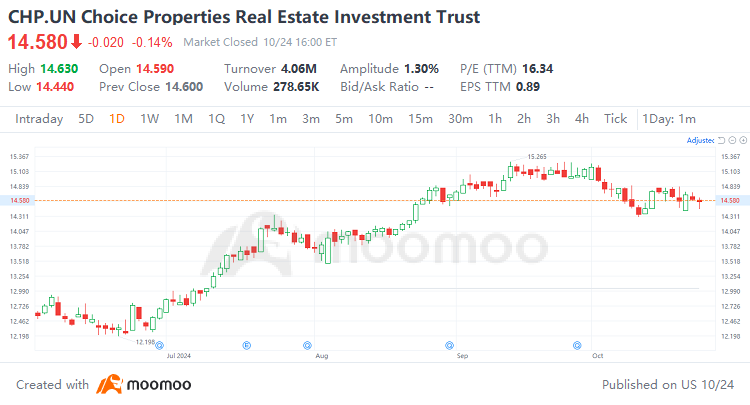

Choice Properties Real Estate Investment Trust (CHP.UN)は、主にカナダ全土に商業用、小売用、混合用、住宅用の物件に投資し、主にスーパーマーケットや独立系食料品店が支配するショッピングセンターに焦点を当てています。物件の多くはオンタリオ州とケベック州にあります。Choice Propertiesの収入の大部分は、賃貸物件をテナントに提供することから得られ、主要なテナントは大手小売業者であるLoblaw Companiesであり、総賃料の大部分を占めています。

2024年10月24日現在、CHPは総時価総額が47.8億カナダドルで、配当利回りは5.160%で、カナダの無リスク金利を上回っています。2024年6月5日以来、CHPは14.64%上昇しています。会社の最新の配当は株当たり0.063カナダドルであり、安定した配当支払い頻度を維持しています。

2.REIt-関連etf:

不動産投資信託に直接投資する他にも、関連etfは堅実で安全な投資選択肢を提供します。多様なreitのポートフォリオを通じて、これらのetfはリスクを分散し、投資の透明性を高め、操作を簡素化し、1クリックで多様な投資を実現し、市場変化に柔軟に対応できます。

このetfは、カナダ市場の19のreitをトラッキングしており、その基礎資産は主に小売業、住宅、オフィス型のreitに焦点を当てています。このetfはS&P/TSX Capped REIt Indexのパフォーマンスを再現することで、長期的な資本増成を目指しています。

2024年6月5日以降、XREは11.46%上昇しました。2024年10月24日時点で、この基金の資産は13.3億カナダドルに達し、配当利回りは4.19%で、ほとんどのインデックスファンドよりもかなり高く、一部の高配当株に匹敵します。ただし、このetfの運用費率は0.61%と比較的高く、投資家は10,000カナダドルあたり61カナダドルの運用手数料を支払うことになります。

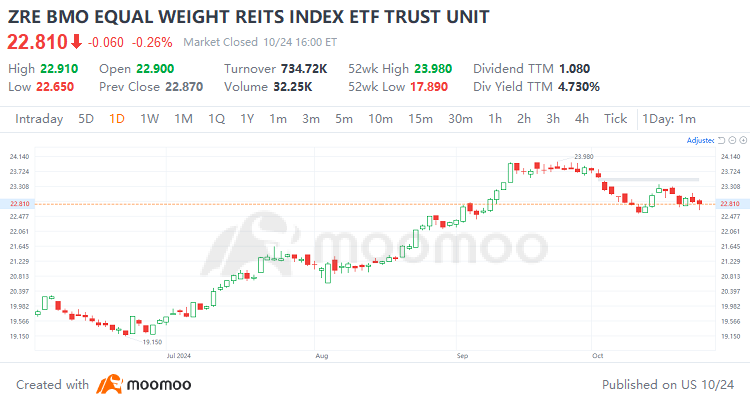

ZREはSolactive Equal Weight Canadian Real Estate Investment Trust Indexをトラッキングし、構成株に均等なウェイトを割り当てています。これにより、指数内の各カナダ不動産投資信託が時価総額に関係なく同じウェイトを持つため、大型reitへの依存を減らし、ポートフォリオの多様性を向上させています。

2024年6月5日以降、ZREは12.75%上昇しました。2024年10月24日時点で、この基金の資産は60800万カナダドルに達し、配当利回りは4.73%です。このカナダのREIt etfも運用管理費率が0.61%です。

株式資産向けに有利:大型株指数、金融、テクノロジーセクターのetfを優先

カナダ銀行によって作られた利下げ環境は株式資産にとって有益です。低金利環境は通常、市場の流動性が増大し、主要指数に大きな位置を占める大規模上場企業は、低コスト資金へのアクセスが容易になり、これらの指数の強力なパフォーマンスにつながることが多いです。セクターに関しては、金融およびテクノロジー産業は利下げ周期中に特に優れた成績を収める傾向があり、より強い耐久性を示すことがあります。金融セクターは、利下げから直接的な恩恵を受けることが多く、低金利によって融資コストが低下することで、融資需要が増加し、銀行や金融機関のパフォーマンスが向上する可能性があります。一方で、革新と成長に敏感なテクノロジーセクターも、金融政策の緩和により強い活力を示すことがあります。

そのため、利下げサイクル中には、大型株指数、金融、およびテクノロジーセクターのetfへの投資を優先することが賢明です。

1. 大型株指数ETF:

iシェアーズ ゴールドトラストIshares S&P/TSX 60 Index ETF(XIU.CA)は、カナダの上場企業市場における時価総額上位60社のパフォーマンスに投資家に露出することを目的としています。このETFは、さまざまなセクターの大型株の優良株を主に投資対象とし、フルレプリケーション戦略を用いて運用されています。XIUの目標は、その基準指数であるS&P/TSX 60 Indexのパフォーマンスをできるだけ正確に追跡することです。

さらに、XIUは低運用手数料で、運用手数料率が0.15%、総費用率(MER)が0.18%です。これはカナダの大型株市場に適した選択肢です。2024年10月24日時点で、XIUの資産は146.49億カナダドルで、配当利回りは2.77%です。2024年6月5日以降、XIUは11.37%上昇しました。

(2)第二提案-株主総会の議決に基づき、普通株式の総数を0.001ドルの1株当たり17.5億株(17.5億株)から50億株(5000万株)に増やす提案を修正します。 $GLOBAL X S&P/TSX 60 INDEX CORPORATE ETF SHS (CAD) (HXT.CA)$

HXt.CAは、Total Return Swapとして知られる革新的な投資構造を使用して、低コストで税効率の良い方法でS&P/TSX 60インデックスの収益を模倣することを目指しています。この構造は、HXtが直接基礎となる指数証券を購入するのではなく、1つまたは複数の取引相手(通常、大手金融機関)と総収益スワップ契約を締結することを意味します。その代わりに、HXtは保有している現金の利子を支払います。したがって、HXtは手数料を差し引いた後の指数の総収益を捉え、その価格に反映されます。投資家は課税対象の配当を受け取ることは期待されていません。

HXTの運用費用率(MER)は0.07%であり、低コストで高効率の投資ツールを求める投資家にとって理想的な選択肢です。2024年10月24日現在、HXTの資産は40.91億カナダドルに達しました。2024年6月5日以来、HXtは12.29%増加しました。

2.金融業界関連のETF:

BMO Equal Weight Banks Index ETF Trust Unit(ZEb.CA)は、カナダ銀行セクターのパフォーマンスを追跡するETFであり、カナダの6大銀行に投資します。カナダ銀行業界への露出を得るための簡単で理解しやすい方法を提供することを目的としています。均等ウェイトの投資戦略を採用することで、ZEb.CAはポートフォリオ内の各銀行が同じウェイトを占めるようにし、特定の銀行のパフォーマンスに依存しないようにします。

2024年6月5日以来、ZEbは14.25%上昇しました。2024年10月24日時点で、ZEBの資産は35.97億カナダドルで、配当利回りは4.08%です。このカナダの金融ETFは、運用手数料率が0.28%です。

iシェアーズ S&P/TSX Capped Financials Index ETF(XFN.CA)はカナダの金融セクターのパフォーマンスを追跡するよう設計されており、S&P/TSX Capped Financials Indexのパフォーマンスを複製して長期資本成長を目指しています。XFN.CAの主要保有銘柄には、カナダの主要銀行や保険会社(例:ロイヤル銀行、トロント・ドミニオン銀行、バンクオブモントリオール)が含まれています。

XFN.CAは、運用手数料が0.55%で、運用経費率(MER)が0.61%と比較的高いです。2024年6月5日時点で、XFNは15.83%増加しました。2024年10月24日時点で、このETFの資産は16.88億カナダドルで、配当利回りは3.10%です。

テクノロジーETF:

XIt.CAは、カナダの情報技術セクターの企業で構成されるS&P/TSX Capped Information Technology Indexのパフォーマンスを再現することで、長期の資本成長を目指しています。個々のコンポーネントのウエイトは25%で上限が設定されています。

XITの運用費用率(MER)は0.60で比較的高く、投資家は考慮すべきです。2024年6月5日以来、XItは17.66%上昇し、過去5年間で129.78%増加しました。10月24日現在、XITの資産はCAD 65300万に達しています。

(2)第二提案-株主総会の議決に基づき、普通株式の総数を0.001ドルの1株当たり17.5億株(17.5億株)から50億株(5000万株)に増やす提案を修正します。 $TD GLOBAL TECH LEADERS INDEX ETF UNIT (TEC.CA)$

TEC.CAは、世界中の中型および大型テクノロジー企業に投資することで、グローバルテクノロジーリーダーのパフォーマンスを追跡することを目指しています。ETFは、Apple、Microsoft、NVIDIA、Amazonなどの企業の株を保持しています。

TECの運用費用率(MER)は0.40%です。2024年6月5日以来、9.09%増加し、過去5年間で累計172.11%上昇しています。10月24日現在、TECの資産はCAD 30.1億で、配当利回りは0.090%、四半期配当政策を採用しています。

4.金やその他の安全資産に焦点を当てる

カナダなどの国々に加えて、連邦準備制度も利下げを開始しました。グローバルな金利引き下げの背景を受けて、米ドルの下落が期待されており、地政学リスクの増加が加わっています。価値の鑑賞と保全のために金を保有することを検討することをお勧めします。

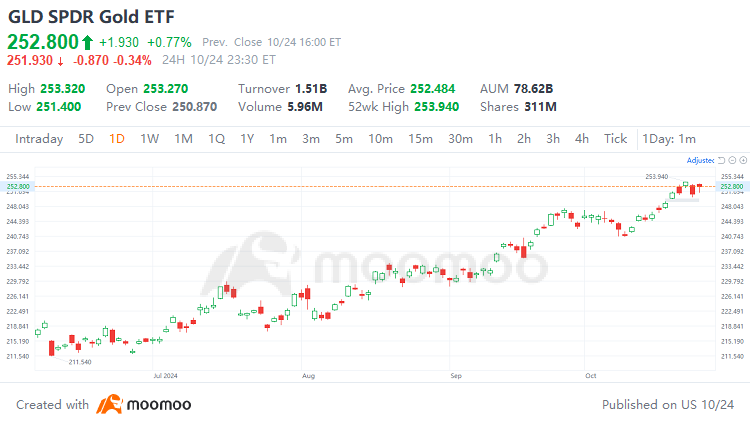

これは、ロンドン金地金市場協会(LBMA)の金価格を追跡している世界最大の金物理etfです。このETFを購入することは、間接的に金を保有することと同等であり、投資家が金価格の上昇から直接的に利益を得る機会を提供し、金の現物価格を追跡する機会を提供します。

2024年6月5日以来、GLDは16.06%上昇しました。2024年10月24日時点で、GLDの資産は786.17億米ドルに達しています。ただし、比較的高い0.4%の経費率を持っており、これが長期投資収益に影響する可能性があります。

これは、LBMAから金価格を追跡している米国市場の別の大規模なgold etfで、投資家に金現物取引への直接アクセスを提供しています。現在の資産は334.02億米ドルで、GLDより低くなっています。2024年6月5日以来、IAUも16%以上上昇しています。IAUはGLDに比べてコストが低く(経費率はわずか0.25%)、ただし、流動性が比較的弱いです。

This is a US ETF that invests in physical gold. Unlike the previous two physical gold ETFs, GLDm has a smaller asset size of USD 96.01億, making it more suitable for smaller investors. Additionally, it has a very low expense ratio of just 0.1%. Since June 5, 2024, GLDm has risen by 16.16%, slightly outperforming GLD and roughly equal to IAU.

結論

In the context of the ongoing rate cuts by the Bank of Canada, investors should carefully formulate their investment strategies. Rate cuts not only create a favorable market environment for bond ETFs and high-dividend ETFs but also present new growth opportunities for the real estate sector and related REITs. Additionally, equity assets, particularly large-cap indices, as well as financial and technology sector ETFs, are likely to benefit from a more accommodative monetary policy environment. At the same time, considering the global trend of rate cuts and geopolitical uncertainties, safe-haven assets like gold also represent a prudent choice.

By diversifying investments across the various ETFs mentioned, investors can capture opportunities during the rate-cutting cycle while also mitigating potential market volatility risks. However, it is essential to recognize that every investment has its specific risk and return characteristics. Therefore, understanding one's risk tolerance and investment objectives is crucial before making decisions. Ultimately, a well-considered asset allocation combined with continuous market observation will be key to achieving stable wealth growth.

免責事項:このコンテンツは、Moomoo Technologies Incが情報交換及び教育目的でのみ提供するものです。

さらに詳しい情報

コメント

サインインコメントをする

101550592 :

Filomena Angeles : とてもありがたい情報..!!ありがとうございます。