萌萌可爱

がいいねしました

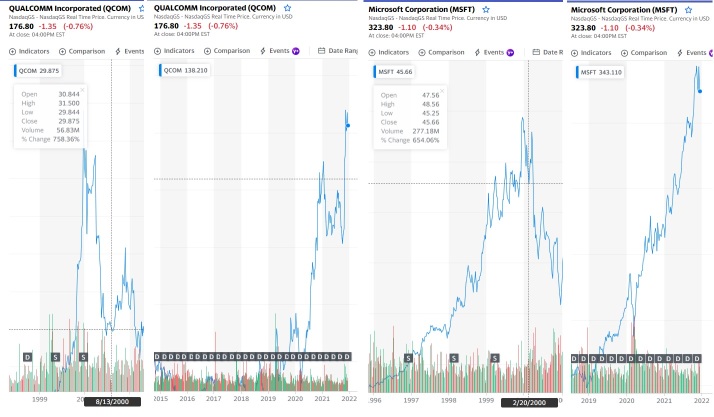

$クアルコム (QCOM.US)$ $マイクロソフト (MSFT.US)$

多くの新規投資家は、今と2000年のドットコム/バブル期のほぼ同様の状況についてのアナリストのレポートを読んでいるか、もしくはすでに読んでいると思います。ここには多くの新しい投資家が、ドットコムの崩壊を知らないかもしれません。私はそのとき現地の投資家でしたが、アメリカ市場へのアクセスが非常に限られていたため、シンガポールでも特にテック株が同様に動いていました。

ここでの最初の注意点は、私がFUDを広めているわけではないということです。しかし、今月のテック株の訂正は、来年の状況がどのようになるかを真剣に考える必要があるため、これについてもっと調査する必要があります。私が注目している3つのシグナルがあります。

1つ目 - ここで非常に明確なシグナルは、ドットコムの崩壊が2000年3月に起き、当時のFED議長であったアラン・グリーンスパンが金利を引き上げました。もし、あなたが来年に何が起こるかを見ることができるなら、それは2022年3月に金利を引き上げることです。

2つ目 - 他のシグナルは、1999年に泡が広がったときには前例のないIPOが起こりました。機関投資家とオーナーのロックイン期間は6か月で、ロックイン後に金利が上昇すると、大量の売りが始まり、それが崩壊につながりました。

3つ目 - 多くのドットコム企業は金利が非常に低い(簡単なお金)ために簡単に資金を調達しました。多くはキャッシュを燃やしており、利益を上げていませんでした。2021年にも、利益が上がっていない過剰評価のテック企業が多く存在しており、過去の高値から下がってはいますが、これも前例のない価格で取引されています

もし上記の3つのシグナルを読むことができるなら、心配になりませんか?

私はドットコムバブルやブームを生き残った2つの企業を添付しました。同様に、価格の下落はほぼ警告レベルです。しかし、それらが利益を出していて、そのような難局を乗り越えることができることが分かります。 $コカコーラ (KO.US)$ 代わりに株が上昇しました

ドットコムバブルの際には、価値のある企業は株価を上げました。

もちろん、その時と今とは状況が異なるかもしれません。2021年12月に一部のテック株が修正され、オミクロン問題もあるため、状況が変わる可能性があります。しかし、私たちの投資には非常に機敏である必要があります。2022年1月と2月、四半期ごとの報告が、2022年がこの実行を継続できるかどうかを検討するための窓口を提供するかもしれません。

全員が冷静な心とさらに優れた集中力を持つことを願っています。感情的になりすぎないでください(私自身へのリマインダーも含む)そして損失を縮小することは肉を切ることではなく、より良く戻ってくる機会に過ぎません。

多くの新規投資家は、今と2000年のドットコム/バブル期のほぼ同様の状況についてのアナリストのレポートを読んでいるか、もしくはすでに読んでいると思います。ここには多くの新しい投資家が、ドットコムの崩壊を知らないかもしれません。私はそのとき現地の投資家でしたが、アメリカ市場へのアクセスが非常に限られていたため、シンガポールでも特にテック株が同様に動いていました。

ここでの最初の注意点は、私がFUDを広めているわけではないということです。しかし、今月のテック株の訂正は、来年の状況がどのようになるかを真剣に考える必要があるため、これについてもっと調査する必要があります。私が注目している3つのシグナルがあります。

1つ目 - ここで非常に明確なシグナルは、ドットコムの崩壊が2000年3月に起き、当時のFED議長であったアラン・グリーンスパンが金利を引き上げました。もし、あなたが来年に何が起こるかを見ることができるなら、それは2022年3月に金利を引き上げることです。

2つ目 - 他のシグナルは、1999年に泡が広がったときには前例のないIPOが起こりました。機関投資家とオーナーのロックイン期間は6か月で、ロックイン後に金利が上昇すると、大量の売りが始まり、それが崩壊につながりました。

3つ目 - 多くのドットコム企業は金利が非常に低い(簡単なお金)ために簡単に資金を調達しました。多くはキャッシュを燃やしており、利益を上げていませんでした。2021年にも、利益が上がっていない過剰評価のテック企業が多く存在しており、過去の高値から下がってはいますが、これも前例のない価格で取引されています

もし上記の3つのシグナルを読むことができるなら、心配になりませんか?

私はドットコムバブルやブームを生き残った2つの企業を添付しました。同様に、価格の下落はほぼ警告レベルです。しかし、それらが利益を出していて、そのような難局を乗り越えることができることが分かります。 $コカコーラ (KO.US)$ 代わりに株が上昇しました

ドットコムバブルの際には、価値のある企業は株価を上げました。

もちろん、その時と今とは状況が異なるかもしれません。2021年12月に一部のテック株が修正され、オミクロン問題もあるため、状況が変わる可能性があります。しかし、私たちの投資には非常に機敏である必要があります。2022年1月と2月、四半期ごとの報告が、2022年がこの実行を継続できるかどうかを検討するための窓口を提供するかもしれません。

全員が冷静な心とさらに優れた集中力を持つことを願っています。感情的になりすぎないでください(私自身へのリマインダーも含む)そして損失を縮小することは肉を切ることではなく、より良く戻ってくる機会に過ぎません。

翻訳済み

30

2

1

萌萌可爱

コメントしました

この素敵な記事を見つけました😉 この買い物が宙に飛ぶことを願って😁

$CRISPRセラピューティクス (CRSP.US)$

https://www.genengnews.com/news/crispr-cas9-breaches-barrier-reveals-route-to-marsupial-models/

$CRISPRセラピューティクス (CRSP.US)$

https://www.genengnews.com/news/crispr-cas9-breaches-barrier-reveals-route-to-marsupial-models/

翻訳済み

3

2

萌萌可爱

がいいねしました

こんにちは、mooerさん。

ファットラのライブです!moomooコミュニティへようこそ!

ここmoomooでは、世界中からのトレーダーが新しい友達と古い友達と一緒に自分の投資経験や概念を共有しています。

あなたはより詳細な投資レビューや、日々の利益と損失、トレーディングディシプリン、個人のトレーディングシステムを構築するためのプロセスなどを見ることができます!

今、面白いことがたくさん起こっています。まず、あちらこちらを案内しましょう!

他の人の投資収支を知りたいですか?参加者たちはここで自分の毎日の収益と損失を共有しています:...

ファットラのライブです!moomooコミュニティへようこそ!

ここmoomooでは、世界中からのトレーダーが新しい友達と古い友達と一緒に自分の投資経験や概念を共有しています。

あなたはより詳細な投資レビューや、日々の利益と損失、トレーディングディシプリン、個人のトレーディングシステムを構築するためのプロセスなどを見ることができます!

今、面白いことがたくさん起こっています。まず、あちらこちらを案内しましょう!

他の人の投資収支を知りたいですか?参加者たちはここで自分の毎日の収益と損失を共有しています:...

翻訳済み

+5

10K

200

95

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)