Mathew Lim

コメントしました

$セムコープ・マリン (S51.SG)$ どうして私の株がなくなったのか笑

翻訳済み

5

5

Mathew Lim

投票しました

翻訳済み

1

1

Mathew Lim

がいいねしました

$Nikko AM STI ETF (G3B.SG)$

これにDCAするのは良いです

これにDCAするのは良いです

翻訳済み

12

Mathew Lim

がいいねしました

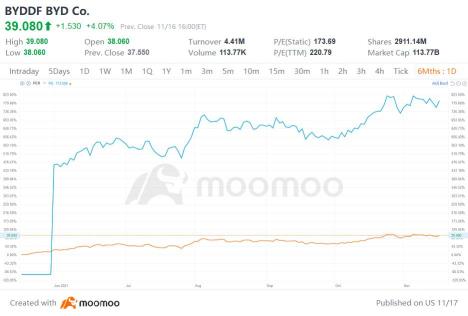

$BYD Co. (BYDDF.US)$ BYD is diversified, growing quickly, and poised to benefit not only from its own EV sales growth, but, thanks to its battery operations, also from the EV sales growth from other automobile companies. Still, BYD is trading at a rather inexpensive price:

While $テスラ (TSLA.US)$, the current EV king, is trading at 26x trailing revenue today, BYD is valued at less than 4x trailing revenue -- despite the fact that it grew its EV sales by more than 210% in October, thereby growing much faster than Tesla. I do not believe that BYD should trade at 25x revenue at all, as I do believe that this also is not a fair valuation for Tesla. Still, at a massive discount to Tesla and even its Chinese EV peers such as $ニオ (NIO.US)$ , $シャオペン (XPEV.US)$ , and $LI・オート(理想汽車) (LI.US)$ , BYD seems like an attractively priced player in this generally rather expensive space. BYD trades, it should be noted, at a premium compared to legacy automakers, but that premium is relatively slim when compared to the valuations other EV players are trading at. At less than 4x trailing revenue, BYD does not look especially expensive, considering its solid market position, strong market tailwinds, and rapid sales growth. Buffett's Berkshire Hathaway holds a multi-billion dollar stake in BYD, suggesting that BYD is one of the best values in this space -- after all, Buffett is an archetypical value investor.

While $テスラ (TSLA.US)$, the current EV king, is trading at 26x trailing revenue today, BYD is valued at less than 4x trailing revenue -- despite the fact that it grew its EV sales by more than 210% in October, thereby growing much faster than Tesla. I do not believe that BYD should trade at 25x revenue at all, as I do believe that this also is not a fair valuation for Tesla. Still, at a massive discount to Tesla and even its Chinese EV peers such as $ニオ (NIO.US)$ , $シャオペン (XPEV.US)$ , and $LI・オート(理想汽車) (LI.US)$ , BYD seems like an attractively priced player in this generally rather expensive space. BYD trades, it should be noted, at a premium compared to legacy automakers, but that premium is relatively slim when compared to the valuations other EV players are trading at. At less than 4x trailing revenue, BYD does not look especially expensive, considering its solid market position, strong market tailwinds, and rapid sales growth. Buffett's Berkshire Hathaway holds a multi-billion dollar stake in BYD, suggesting that BYD is one of the best values in this space -- after all, Buffett is an archetypical value investor.

22

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Mathew Lim : 私も同じです。セムコープマリンのわずかな株しか持っていません。moomooのディスプレイに何か問題があるのでしょうか。