ME10086

がいいねしました

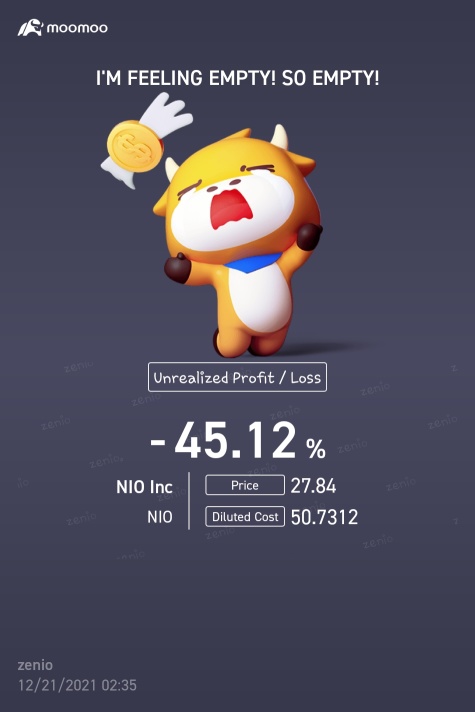

$テスラ (TSLA.US)$ $パランティア・テクノロジーズ (PLTR.US)$ $ソーファイ (SOFI.US)$ $ニオ (NIO.US)$ $アップル (AAPL.US)$ $Meta Platforms (FB.US)$ $グラブ・ホールディングス (GRAB.US)$

ただ中立を取る

今、市場のボラティリティはこれまでにない。上昇余地はわずかで、下降リスクは限りない。次の2ヶ月間に何もせずに中立を取り続けるのが唯一の方法です。他の方法でお金を稼ぎましょう。売却し、バランスを短期売買に使うのは避けましょう。もしそうしなければ、あなたは損失を被ります。

ただ中立を取る

今、市場のボラティリティはこれまでにない。上昇余地はわずかで、下降リスクは限りない。次の2ヶ月間に何もせずに中立を取り続けるのが唯一の方法です。他の方法でお金を稼ぎましょう。売却し、バランスを短期売買に使うのは避けましょう。もしそうしなければ、あなたは損失を被ります。

翻訳済み

32

10

ME10086

がいいねしました

あなたのポートフォリオは回復します。回復しない場合でも、お金は稼げます。今、影響を受けている国々にいなくて良かったと思うべきです。失われた命は二度と戻って来ません。

世界平和を祈っています 🙏🏼

愛を広めましょう、憎しみではありません

$テスラ (TSLA.US)$

$アップル (AAPL.US)$

$SPDR S&P 500 ETF (SPY.US)$

$S&P 500 Index (.SPX.US)$

$マイクロソフト (MSFT.US)$

$エヌビディア (NVDA.US)$

$パランティア・テクノロジーズ (PLTR.US)$

$アリババ・グループ (BABA.US)$

世界平和を祈っています 🙏🏼

愛を広めましょう、憎しみではありません

$テスラ (TSLA.US)$

$アップル (AAPL.US)$

$SPDR S&P 500 ETF (SPY.US)$

$S&P 500 Index (.SPX.US)$

$マイクロソフト (MSFT.US)$

$エヌビディア (NVDA.US)$

$パランティア・テクノロジーズ (PLTR.US)$

$アリババ・グループ (BABA.US)$

翻訳済み

179

19

ME10086

がいいねしました

As long as you don't let fear settle in, FOMO is always an option. Your power, your choice - I choose JOMO, take a break, refresh myself once a while to regain the big picture instead of frantically keeping track of my losses. Sometimes fear is just fake evidence appearing real, the market is cyclical and risks are inevitable. We choose it, win or lose it. Some losses will take forever to recover or maybe never will. The key is to continue finding othe...

17

ME10086

がいいねしました

I started the series liking the sisterhood between Powder and Violet.

I especially resonated with Powder’s ingenuity and young raw talent. I found her innovative and determined spirit very inspiring. But as her crazy started to show I lost touch with her motivations.

I believe all these draw parallels to our investing journey. When we are consumed by greed![]() and laziness

and laziness![]() our actions looks nonsensical and we loose touch with o...

our actions looks nonsensical and we loose touch with o...

I especially resonated with Powder’s ingenuity and young raw talent. I found her innovative and determined spirit very inspiring. But as her crazy started to show I lost touch with her motivations.

I believe all these draw parallels to our investing journey. When we are consumed by greed

![ARCANE: Midseason thoughts and how to Deal with losses [Non Spoiler!]](https://ussnsimg.moomoo.com/moo-1642532306-102685100-iPhone-1-org.gif/thumb)

![ARCANE: Midseason thoughts and how to Deal with losses [Non Spoiler!]](https://ussnsimg.moomoo.com/moo-1642532308-102685100-iPhone-2-org.gif/thumb)

![ARCANE: Midseason thoughts and how to Deal with losses [Non Spoiler!]](https://ussnsimg.moomoo.com/moo-1642532311-102685100-iPhone-5-org.jpg/thumb)

+6

7

7

ME10086

投票しました

$アップル (AAPL.US)$2018年8月2日、アップルは1兆円の時価総額に達しました。約2年後の2020年8月19日、 $アップル (AAPL.US)$アップルは2兆円の時価総額に達しました。![]()

さらに2年も経たないうちに、2022年1月3日には、アップルは3兆円の時価総額に達しました! $アップル (AAPL.US)$さらに2年も経たないうちに、2022年1月3日には、アップルは3兆円の時価総額に達しました!![]()

フォーブスがツイートしたように、アップルの時価総額はイギリスのGDPよりも大きいです。![]()

これは完全に素晴らしいです!![]()

さらに、 $アップル (AAPL.US)$アクティブな株式オプションのトップ8の1つです。

さらに2年も経たないうちに、2022年1月3日には、アップルは3兆円の時価総額に達しました! $アップル (AAPL.US)$さらに2年も経たないうちに、2022年1月3日には、アップルは3兆円の時価総額に達しました!

フォーブスがツイートしたように、アップルの時価総額はイギリスのGDPよりも大きいです。

これは完全に素晴らしいです!

さらに、 $アップル (AAPL.US)$アクティブな株式オプションのトップ8の1つです。

翻訳済み

14

7

ME10086

いいねしてコメントしました

$アップル (AAPL.US)$ $マイクロソフト (MSFT.US)$

Be careful with this sentiment. It seems like everyone suddenly thinks AAPL is invincible. I hold AAPL and plan on never selling, and definitely won't be trying to time it (unless it gets very cheap). But even AAPL goes through periods of greed and fear. Not so long ago (early 2019) there was a massive sell-off for AAPL (I loaded up back then as it was a really good deal) and the stock didn't get back to its ATH until over a year after the previous ATH in Sep 2018.

That was a short while ago, and even though the company grew a lot since then and it has quite different fundamentals going on, I wouldn't be so confident that it's a completely safe investment (again, I am a long-time holder and don't plan on selling). Ffs, I've seen AAPL referred to as a cash-like investment three times this week! It's not and it never will be. It's a damn good company, but it's incredible how overly optimistic people became about this stock seemingly overnight (well, over the last month, really). Hell, even going back to October or summer, you wouldn't see anyone refer to it as a savings account or a cash-like holding. It's all just an echo chamber and the current state of the market (with MSFT and AAPL outperforming recently) makes everyone think it will only go up. Long time, sure, that's very likely and I am very confident in that. But even this year it had a period of almost -20% over a couple months. Just two months ago, there was a -10% correction. There will be more of those, so stop treating it like cash. I don't think you'd post a comment like this just two months ago.

Be careful with this sentiment. It seems like everyone suddenly thinks AAPL is invincible. I hold AAPL and plan on never selling, and definitely won't be trying to time it (unless it gets very cheap). But even AAPL goes through periods of greed and fear. Not so long ago (early 2019) there was a massive sell-off for AAPL (I loaded up back then as it was a really good deal) and the stock didn't get back to its ATH until over a year after the previous ATH in Sep 2018.

That was a short while ago, and even though the company grew a lot since then and it has quite different fundamentals going on, I wouldn't be so confident that it's a completely safe investment (again, I am a long-time holder and don't plan on selling). Ffs, I've seen AAPL referred to as a cash-like investment three times this week! It's not and it never will be. It's a damn good company, but it's incredible how overly optimistic people became about this stock seemingly overnight (well, over the last month, really). Hell, even going back to October or summer, you wouldn't see anyone refer to it as a savings account or a cash-like holding. It's all just an echo chamber and the current state of the market (with MSFT and AAPL outperforming recently) makes everyone think it will only go up. Long time, sure, that's very likely and I am very confident in that. But even this year it had a period of almost -20% over a couple months. Just two months ago, there was a -10% correction. There will be more of those, so stop treating it like cash. I don't think you'd post a comment like this just two months ago.

5

1

ME10086

がいいねしました

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)