The Geo-Jade Petroleum Corporation (SHSE:600759) share price has done very well over the last month, posting an excellent gain of 27%. Notwithstanding the latest gain, the annual share price return of 6.2% isn't as impressive.

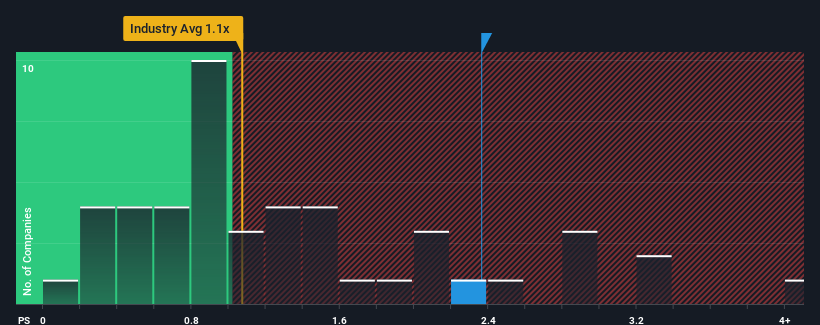

Since its price has surged higher, you could be forgiven for thinking Geo-Jade Petroleum is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.4x, considering almost half the companies in China's Oil and Gas industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Geo-Jade Petroleum

How Geo-Jade Petroleum Has Been Performing

Revenue has risen firmly for Geo-Jade Petroleum recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Revenue has risen firmly for Geo-Jade Petroleum recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Geo-Jade Petroleum would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 28%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 6.1% shows it's noticeably less attractive.

With this information, we find it concerning that Geo-Jade Petroleum is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Geo-Jade Petroleum's P/S

Geo-Jade Petroleum's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Geo-Jade Petroleum currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Geo-Jade Petroleum that you should be aware of.

If these risks are making you reconsider your opinion on Geo-Jade Petroleum, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.