Passive investing in index funds can generate returns that roughly match the overall market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Jiangsu Luokai Mechanical &Electrical Co., Ltd . (SHSE:603829) share price is up 86% in the last 1 year, clearly besting the market decline of around 5.3% (not including dividends). So that should have shareholders smiling. And shareholders have also done well over the long term, with an increase of 71% in the last three years.

Since the stock has added CN¥712m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Jiangsu Luokai Mechanical &Electrical

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

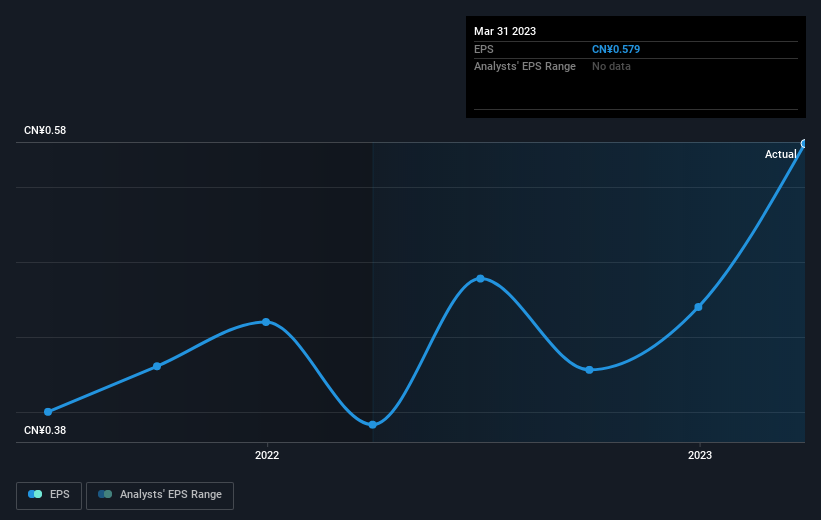

During the last year Jiangsu Luokai Mechanical &Electrical grew its earnings per share (EPS) by 48%. The share price gain of 86% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Jiangsu Luokai Mechanical &Electrical's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Jiangsu Luokai Mechanical &Electrical shareholders have received a total shareholder return of 88% over the last year. That's including the dividend. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Jiangsu Luokai Mechanical &Electrical you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.