Summary

The U.S. Federal Reserve (the Fed) cut interest rates again today - its third such move in as many meetings - lowering its benchmark rate to a target range of 1.50% to 1.75%.Bond yields, as evidenced by the yield on the 10-year U.S. Treasury note, moved higher in the minutes around the announcement.The biggest surprise driving the re-pricing in yields was the softening of forward guidance.The U.S. Federal Reserve (the Fed) cut interest rates again today - its third such move in as many meetings - lowering its benchmark rate to a target range of 1.50% to 1.75%. At 75 basis points, the current easing cycle now matches the degree of insurance that the Fed provided around similar slowdowns in 1995 and 1998. This cut to overnight interest rates also serves to effectively un-invert the entirety of the Treasury yield curve and bolster the Fed's confidence that its monetary policy stance is indeed accommodative, even when accounting for the headwinds from the China-U.S. trade war.

Bond yields, as evidenced by the yield on the 10-year U.S. Treasury note, moved higher in the minutes around the announcement. The biggest surprise driving the re-pricing in yields was the softening of forward guidance. Since June, the Fed has messaged that it will act as appropriate to sustain the expansion. This line was removed and replaced with blander language stating simply that the Committee will assess the appropriate path of interest rates.

Translation: The Federal Open Market Committee (FOMC) thinks its three rate cuts are now sufficient to push back against the downside risks from the trade war. The hurdle for further action from here is much higher.

Model Strategies

Is a prolonged pause next?

Our baseline has been that the Fed would cut in July, September and October and then go on a prolonged pause. That baseline forecast, if anything, has simply been reinforced by today's developments. When we consider the risks around this view, it still looks to us as though there's an asymmetry, in that the Fed is more likely to cut than hike rates through the end of 2020. This thinking is motivated by two key insights:

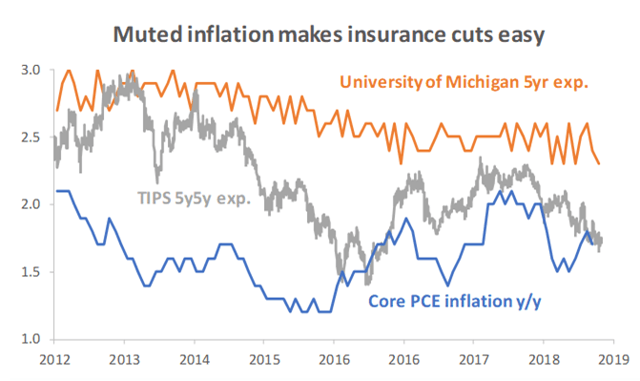

- First, inflation expectations are below levels that would be consistent with the Fed's 2% price stability objective over the medium-term. For example, the gray line in the chart below shows 5-year, 5-year forward inflation expectations embedded in the pricing of Treasury Inflation Protected Securities (TIPS) are trading at just 1.7%. We and the Fed would want to see TIPS pricing closer to 2.25% to be more confident in core personal consumption expenditure (PCE) inflation holding at the 2% objective.

Furthermore, the inflationary expectations of U.S. consumers have recently downshifted to an all-time low (orange line). The price for cutting rates late in the cycle is usually that it could risk an overshoot of inflation. However, right now a bit more inflation would actually be a welcome development. In our view, that makes the Fed's calculus skew in favor of a cut should risks to the outlook re-intensify.

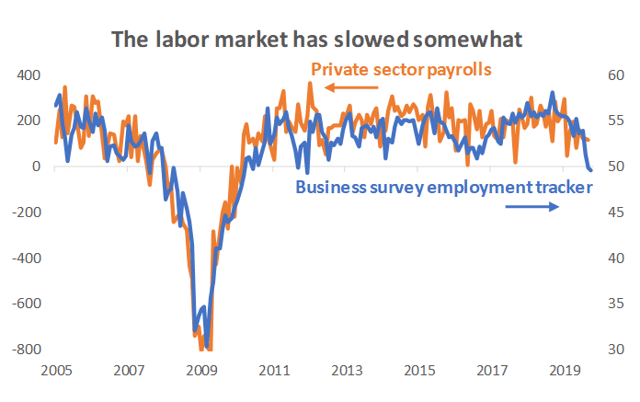

Source: Thomson Reuters Datastream, Russell Investments data as of October 29th 2019. - Second, the balance of risks to the global business cycle still skew modestly to the downside in our view. Manufacturing activity has downshifted to recessionary levels in the United States and across most of the developed markets. And while some high frequency manufacturing data for September and October points to a tentative stabilization at weak levels, the weakness itself will be a concern for policymakers. Additionally, the services sector and U.S. labor market (which typically lags manufacturing by a month or more) still show signs of potentially slowing further. Healthy employment growth and robust wage gains have supported the U.S. consumer. If the labor market slows and endangers the expansion, further rate cuts could be warranted.

Source: Bureau of Labor Statistics, Russell Investments data as of October 30th 2019. The business survey employment tracker is a custom composite indicator based on underlying data from Markit, the Institute for Supply Management, and the Federal Reserve System. Preliminary data for October is shown.

The bottom line

Considering these risks to the outlook, current market pricing on the near-term path for interest rates (i.e., one more rate cut through the end of 2020) looks broadly appropriate to us, even though our baseline is for the Fed to remain on hold. With the expansion entering its eleventh year, we still think government bonds have an important diversifying role to play in multi-asset portfolios.

On the upside, further evidence of progress toward a phase 1 deal between the U.S. and China, and importantly, an eventual removal of the tariffs that have been put in place, would be key to lifting the cloud of uncertainty hanging over the corporate sector and re-accelerating global fundamentals and risk markets in the year ahead.

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page.

Investing involves risk and principal loss is possible.

Past performance does not guarantee future performance.

Forecasting represents predictions of market prices and/or volume patterns utilizing varying analytical data. It is not representative of a projection of the stock market, or of any specific investment.

This material is not an offer, solicitation or recommendation to purchase any security. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Please remember that all investments carry some level of risk. Although steps can be taken to help reduce risk it cannot be completely removed. They do no not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

Investments that are allocated across multiple types of securities may be exposed to a variety of risks based on the asset classes, investment styles, market sectors, and size of companies preferred by the investment managers. Investors should consider how the combined risks impact their total investment portfolio and understand that different risks can lead to varying financial consequences, including loss of principal. Please see a prospectus for further details.

Indexes are unmanaged and cannot be invested in directly.

Russell Investments' ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments' management.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the "FTSE RUSSELL" brand.

Copyright © Russell Investments Group LLC 2019. All rights reserved.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an "as is" basis without warranty.

UNI-11555

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.