Sansheng Intellectual Education Technology CO.,LTD. (SZSE:300282) shareholders will doubtless be very grateful to see the share price up 49% in the last month. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 67% after a long stretch. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

While the stock has risen 47% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Sansheng Intellectual Education TechnologyLTD

Sansheng Intellectual Education TechnologyLTD wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Sansheng Intellectual Education TechnologyLTD wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Sansheng Intellectual Education TechnologyLTD reduced its trailing twelve month revenue by 25% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 11% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

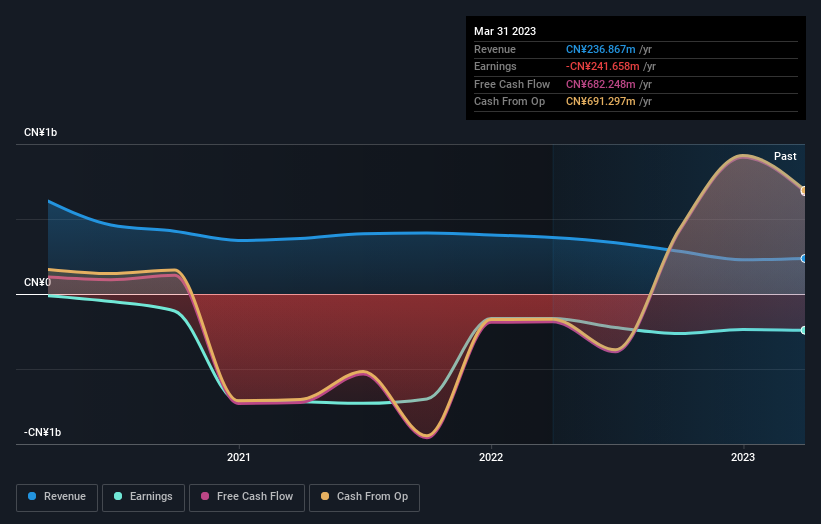

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Sansheng Intellectual Education TechnologyLTD's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Sansheng Intellectual Education TechnologyLTD shareholders have received a total shareholder return of 20% over one year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Sansheng Intellectual Education TechnologyLTD better, we need to consider many other factors. Take risks, for example - Sansheng Intellectual Education TechnologyLTD has 2 warning signs we think you should be aware of.

But note: Sansheng Intellectual Education TechnologyLTD may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.