Hua Lien International (Holding) Company Limited (HKG:969) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 99%, which is great even in a bull market.

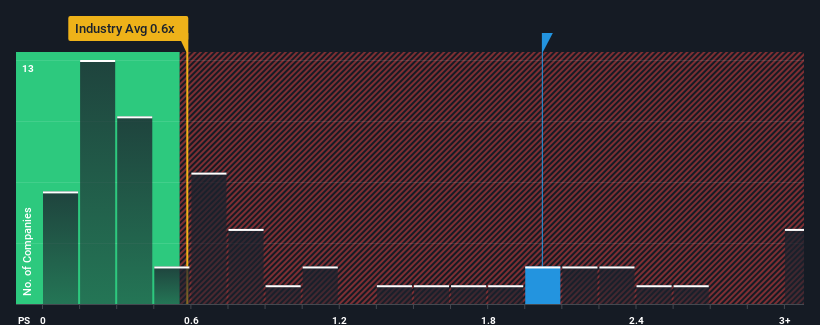

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Food industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider Hua Lien International (Holding) as a stock to potentially avoid with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Hua Lien International (Holding)

How Hua Lien International (Holding) Has Been Performing

The recent revenue growth at Hua Lien International (Holding) would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hua Lien International (Holding) will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Hua Lien International (Holding) would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.1%. Still, lamentably revenue has fallen 2.9% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 7.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Hua Lien International (Holding)'s P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Hua Lien International (Holding)'s P/S Mean For Investors?

Hua Lien International (Holding)'s P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hua Lien International (Holding) currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

You need to take note of risks, for example - Hua Lien International (Holding) has 4 warning signs (and 3 which are significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.