It hasn't been the best quarter for CoStar Group, Inc. (NASDAQ:CSGP) shareholders, since the share price has fallen 10% in that time. But that doesn't change the fact that shareholders have received really good returns over the last five years. In fact, the share price is 109% higher today. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for CoStar Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

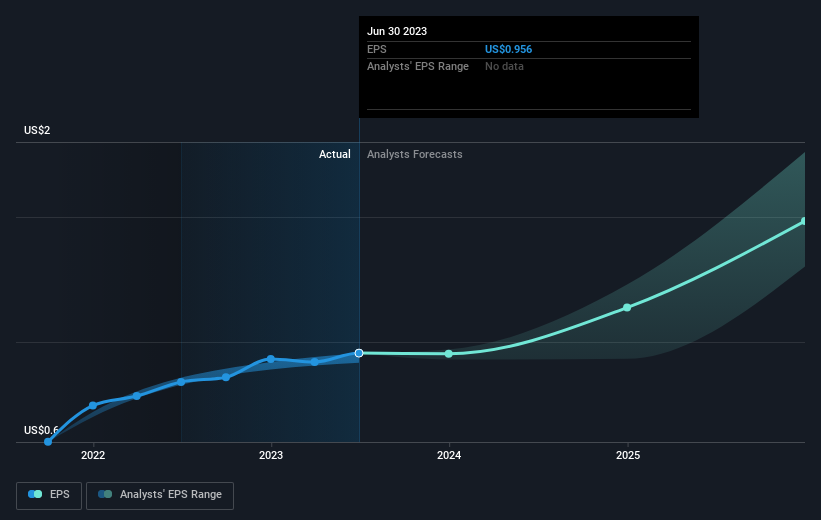

Over half a decade, CoStar Group managed to grow its earnings per share at 14% a year. So the EPS growth rate is rather close to the annualized share price gain of 16% per year. That suggests that the market sentiment around the company hasn't changed much over that time. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that CoStar Group has improved its bottom line lately, but is it going to grow revenue? Check if analysts think CoStar Group will grow revenue in the future.

A Different Perspective

CoStar Group shareholders gained a total return of 14% during the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 16% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. If you would like to research CoStar Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.