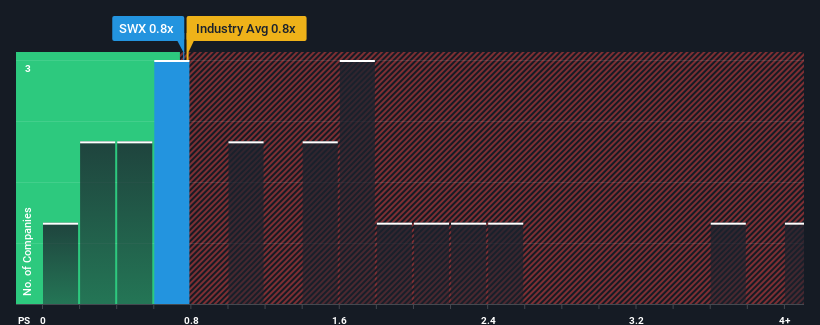

Southwest Gas Holdings, Inc.'s (NYSE:SWX) price-to-sales (or "P/S") ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Gas Utilities industry in the United States have P/S ratios greater than 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Southwest Gas Holdings

What Does Southwest Gas Holdings' P/S Mean For Shareholders?

Southwest Gas Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Southwest Gas Holdings.How Is Southwest Gas Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Southwest Gas Holdings would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Southwest Gas Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow revenue by 72% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 16% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 2.6% per year, which paints a poor picture.

With this information, we are not surprised that Southwest Gas Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Southwest Gas Holdings' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Southwest Gas Holdings' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Southwest Gas Holdings (2 are a bit concerning!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.