We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. Zooming in on an example, the FIT Hon Teng Limited (HKG:6088) share price dropped 70% in the last half decade. We certainly feel for shareholders who bought near the top. Furthermore, it's down 23% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 11% decline in the broader market, throughout the period.

Since FIT Hon Teng has shed HK$992m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for FIT Hon Teng

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

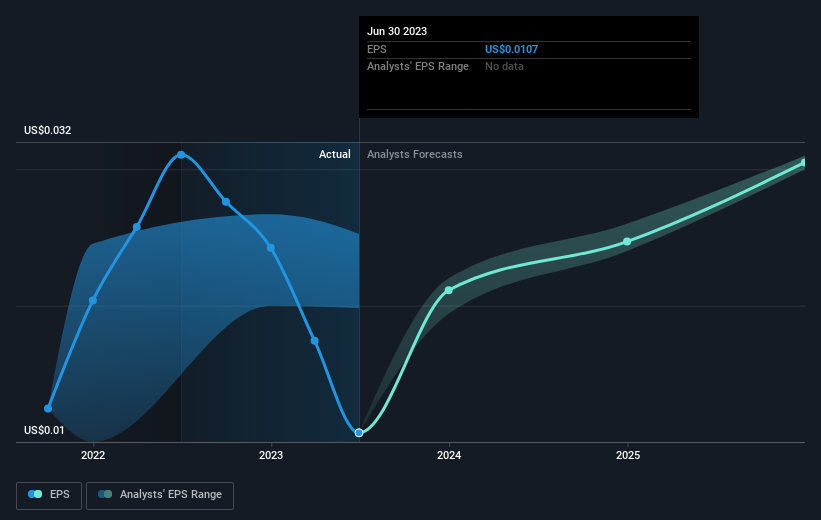

During the five years over which the share price declined, FIT Hon Teng's earnings per share (EPS) dropped by 20% each year. This change in EPS is remarkably close to the 21% average annual decrease in the share price. This suggests that market participants have not changed their view of the company all that much. So it's fair to say the share price has been responding to changes in EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on FIT Hon Teng's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

FIT Hon Teng provided a TSR of 14% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 11% per year, over five years. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that FIT Hon Teng is showing 1 warning sign in our investment analysis , you should know about...

Of course FIT Hon Teng may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.