The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you buy shares in a really great company, you can more than double your money. For instance the Adtalem Global Education Inc. (NYSE:ATGE) share price is 113% higher than it was three years ago. How nice for those who held the stock! It's even up 18% in the last week. This could be related to the recent financial results, released less than a week ago -- you can catch up on the most recent data by reading our company report.

The past week has proven to be lucrative for Adtalem Global Education investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for Adtalem Global Education

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years of share price growth, Adtalem Global Education actually saw its earnings per share (EPS) drop 16% per year.

This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

It may well be that Adtalem Global Education revenue growth rate of 18% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

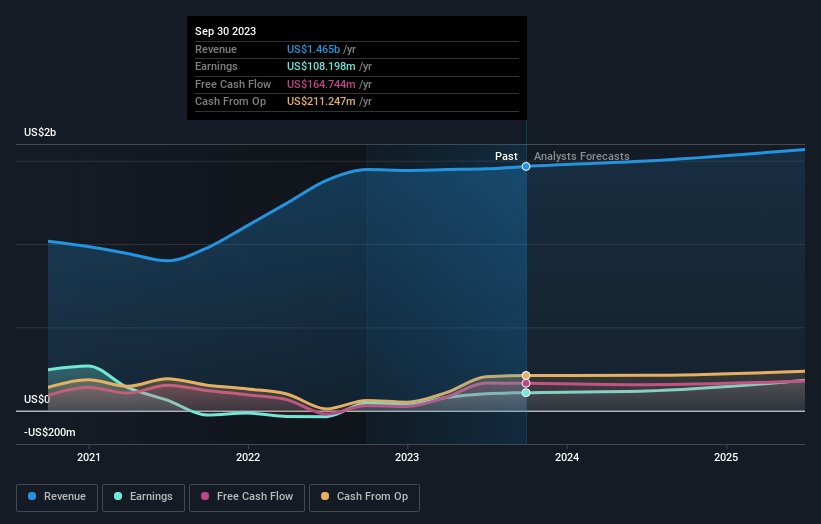

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Adtalem Global Education has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Adtalem Global Education in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Adtalem Global Education shareholders have received a total shareholder return of 20% over one year. That certainly beats the loss of about 1.7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. If you would like to research Adtalem Global Education in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.