The latest analyst coverage could presage a bad day for Xiamen Hexing Packaging Printing Co., Ltd. (SZSE:002228), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business. The stock price has risen 6.2% to CN¥3.45 over the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

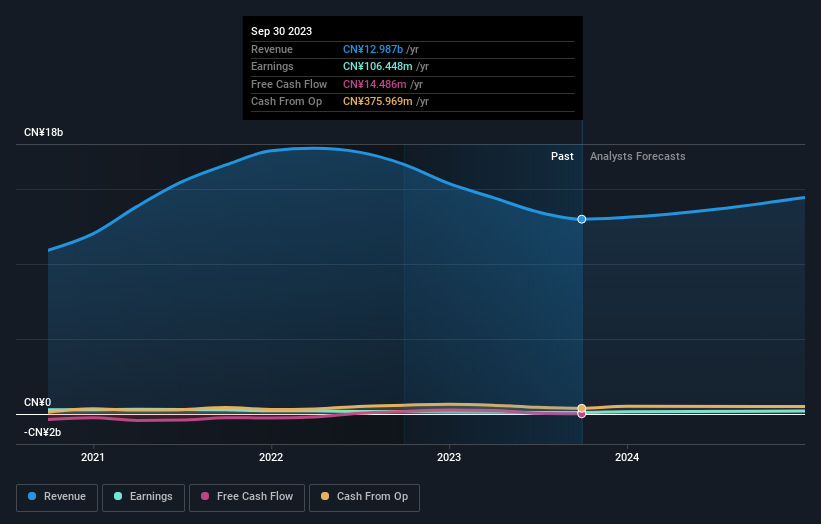

Following this downgrade, Xiamen Hexing Packaging Printing's solo analyst are forecasting 2023 revenues to be CN¥13b, approximately in line with the last 12 months. Statutory earnings per share are presumed to jump 46% to CN¥0.13. Previously, the analyst had been modelling revenues of CN¥16b and earnings per share (EPS) of CN¥0.16 in 2023. Indeed, we can see that the analyst is a lot more bearish about Xiamen Hexing Packaging Printing's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for Xiamen Hexing Packaging Printing

The analyst made no major changes to their price target of CN¥3.60, suggesting the downgrades are not expected to have a long-term impact on Xiamen Hexing Packaging Printing's valuation.

The analyst made no major changes to their price target of CN¥3.60, suggesting the downgrades are not expected to have a long-term impact on Xiamen Hexing Packaging Printing's valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Xiamen Hexing Packaging Printing's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 0.9% growth on an annualised basis. This is compared to a historical growth rate of 6.8% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 19% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Xiamen Hexing Packaging Printing.

The Bottom Line

The biggest issue in the new estimates is that the analyst has reduced their earnings per share estimates, suggesting business headwinds lay ahead for Xiamen Hexing Packaging Printing. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Xiamen Hexing Packaging Printing.

That said, this analyst might have good reason to be negative on Xiamen Hexing Packaging Printing, given the risk of cutting its dividend. For more information, you can click here to discover this and the 1 other risk we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.