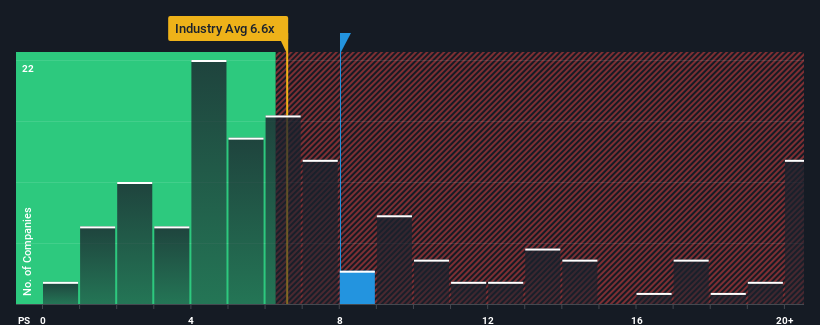

When you see that almost half of the companies in the Software industry in China have price-to-sales ratios (or "P/S") below 6.6x, Shanghai Golden Bridge Info Tech Co.,Ltd (SHSE:603918) looks to be giving off some sell signals with its 8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai Golden Bridge Info TechLtd

How Shanghai Golden Bridge Info TechLtd Has Been Performing

Shanghai Golden Bridge Info TechLtd could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Golden Bridge Info TechLtd.Do Revenue Forecasts Match The High P/S Ratio?

Shanghai Golden Bridge Info TechLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Shanghai Golden Bridge Info TechLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 5.3% overall rise in revenue. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 43% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 37%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Shanghai Golden Bridge Info TechLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanghai Golden Bridge Info TechLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Shanghai Golden Bridge Info TechLtd you should know about.

If these risks are making you reconsider your opinion on Shanghai Golden Bridge Info TechLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.