Nanjing Inform Storage Equipment (Group) Co., Ltd. (SHSE:603066) shareholders have had their patience rewarded with a 43% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

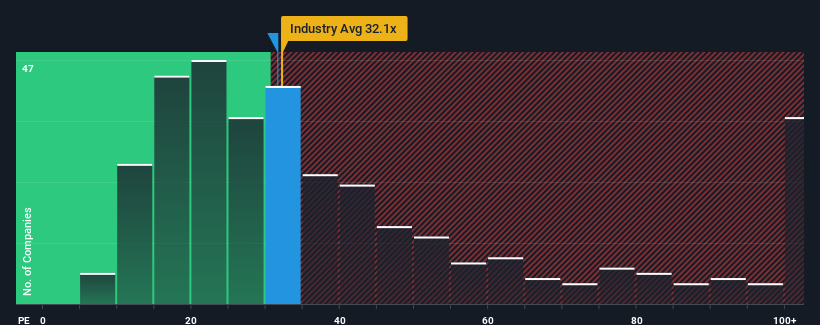

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Nanjing Inform Storage Equipment (Group)'s P/E ratio of 31.6x, since the median price-to-earnings (or "P/E") ratio in China is also close to 35x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We'd have to say that with no tangible growth over the last year, Nanjing Inform Storage Equipment (Group)'s earnings have been unimpressive. One possibility is that the P/E is moderate because investors think this benign earnings growth rate might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Nanjing Inform Storage Equipment (Group)

Check out our latest analysis for Nanjing Inform Storage Equipment (Group)

How Is Nanjing Inform Storage Equipment (Group)'s Growth Trending?

The only time you'd be comfortable seeing a P/E like Nanjing Inform Storage Equipment (Group)'s is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 67% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 44% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Nanjing Inform Storage Equipment (Group) is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Final Word

Its shares have lifted substantially and now Nanjing Inform Storage Equipment (Group)'s P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nanjing Inform Storage Equipment (Group) currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Nanjing Inform Storage Equipment (Group) you should know about.

Of course, you might also be able to find a better stock than Nanjing Inform Storage Equipment (Group). So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.