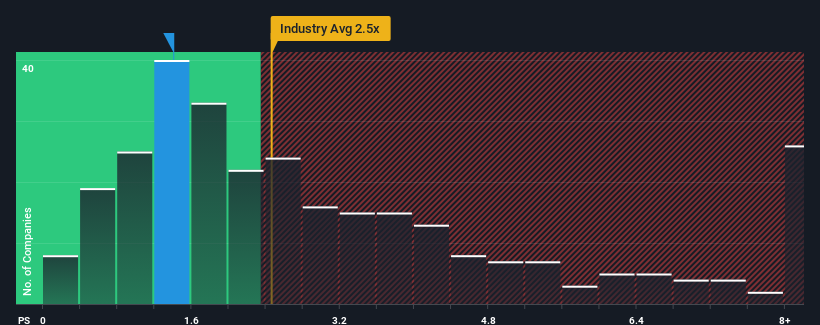

With a price-to-sales (or "P/S") ratio of 1.4x Farasis Energy (Gan Zhou) Co., Ltd. (SHSE:688567) may be sending bullish signals at the moment, given that almost half of all the Electrical companies in China have P/S ratios greater than 2.5x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Farasis Energy (Gan Zhou)

How Farasis Energy (Gan Zhou) Has Been Performing

Recent times have been advantageous for Farasis Energy (Gan Zhou) as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Farasis Energy (Gan Zhou) will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Farasis Energy (Gan Zhou)?

In order to justify its P/S ratio, Farasis Energy (Gan Zhou) would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Farasis Energy (Gan Zhou) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 66% during the coming year according to the four analysts following the company. That's shaping up to be materially higher than the 31% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Farasis Energy (Gan Zhou)'s P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Farasis Energy (Gan Zhou)'s revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Farasis Energy (Gan Zhou) with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.