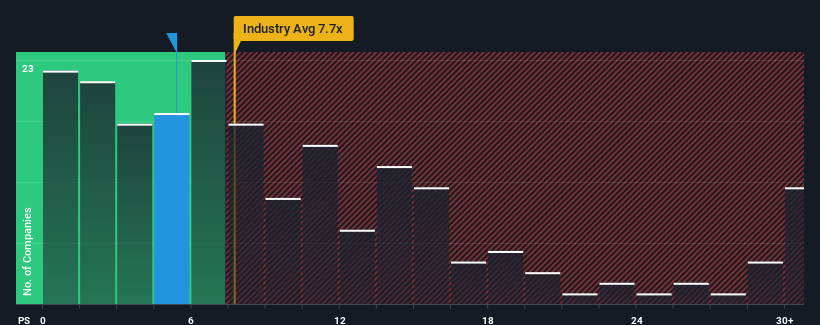

Forehope Electronic (Ningbo) Co., Ltd.'s (SHSE:688362) price-to-sales (or "P/S") ratio of 5.4x might make it look like a buy right now compared to the Semiconductor industry in China, where around half of the companies have P/S ratios above 7.7x and even P/S above 15x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Forehope Electronic (Ningbo)

What Does Forehope Electronic (Ningbo)'s P/S Mean For Shareholders?

Forehope Electronic (Ningbo) hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Forehope Electronic (Ningbo).Is There Any Revenue Growth Forecasted For Forehope Electronic (Ningbo)?

In order to justify its P/S ratio, Forehope Electronic (Ningbo) would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Forehope Electronic (Ningbo) would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. Still, the latest three year period has seen an excellent 180% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 46% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 41% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Forehope Electronic (Ningbo)'s P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Forehope Electronic (Ningbo)'s P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Forehope Electronic (Ningbo)'s analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 2 warning signs we've spotted with Forehope Electronic (Ningbo).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.