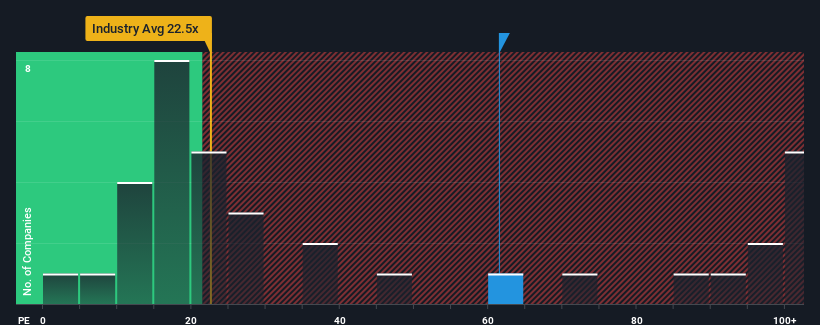

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 34x, you may consider Guangdong KinLong Hardware Products Co.,Ltd. (SZSE:002791) as a stock to avoid entirely with its 61.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Guangdong KinLong Hardware ProductsLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Guangdong KinLong Hardware ProductsLtd

How Is Guangdong KinLong Hardware ProductsLtd's Growth Trending?

In order to justify its P/E ratio, Guangdong KinLong Hardware ProductsLtd would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 86%. However, this wasn't enough as the latest three year period has seen a very unpleasant 70% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 88% as estimated by the nine analysts watching the company. With the market only predicted to deliver 44%, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Guangdong KinLong Hardware ProductsLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Guangdong KinLong Hardware ProductsLtd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Guangdong KinLong Hardware ProductsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Guangdong KinLong Hardware ProductsLtd with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.