It hasn't been the best quarter for Bestway Marine & Energy Technology Co.,Ltd (SZSE:300008) shareholders, since the share price has fallen 13% in that time. But that doesn't change the fact that the returns over the last five years have been respectable. It's good to see the share price is up 50% in that time, better than its market return of 46%. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 37% in the last three years.

Since the long term performance has been good but there's been a recent pullback of 6.5%, let's check if the fundamentals match the share price.

Check out our latest analysis for Bestway Marine & Energy TechnologyLtd

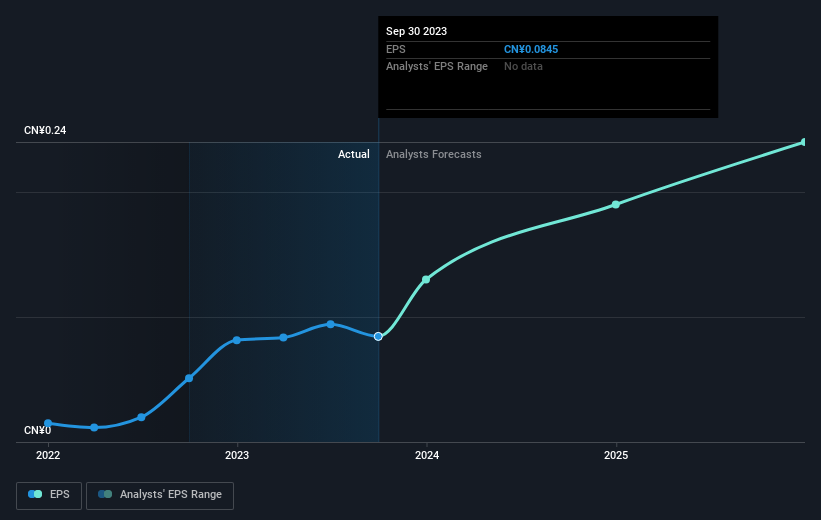

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Bestway Marine & Energy TechnologyLtd became profitable. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Bestway Marine & Energy TechnologyLtd has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Bestway Marine & Energy TechnologyLtd shareholders have received a total shareholder return of 0.5% over one year. However, the TSR over five years, coming in at 8% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Bestway Marine & Energy TechnologyLtd you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.