Jiangsu LiXing General Steel Ball Co.,Ltd. (SZSE:300421) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 34% in the last year.

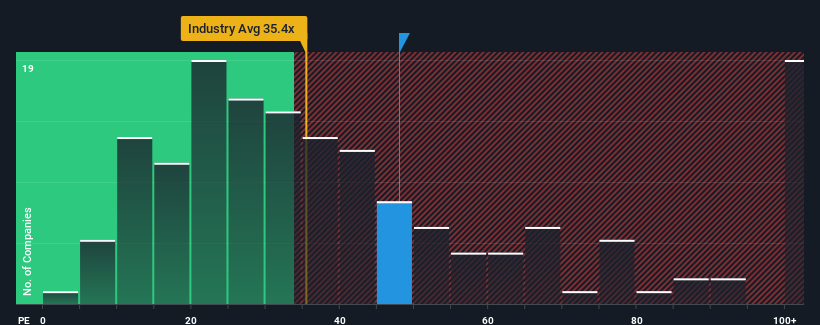

Following the firm bounce in price, Jiangsu LiXing General Steel BallLtd's price-to-earnings (or "P/E") ratio of 48x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 34x and even P/E's below 20x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Jiangsu LiXing General Steel BallLtd has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Jiangsu LiXing General Steel BallLtd

View our latest analysis for Jiangsu LiXing General Steel BallLtd

How Is Jiangsu LiXing General Steel BallLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Jiangsu LiXing General Steel BallLtd's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 75% gain to the company's bottom line. Pleasingly, EPS has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 164% over the next year. That's shaping up to be materially higher than the 44% growth forecast for the broader market.

In light of this, it's understandable that Jiangsu LiXing General Steel BallLtd's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Jiangsu LiXing General Steel BallLtd's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Jiangsu LiXing General Steel BallLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Jiangsu LiXing General Steel BallLtd (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.