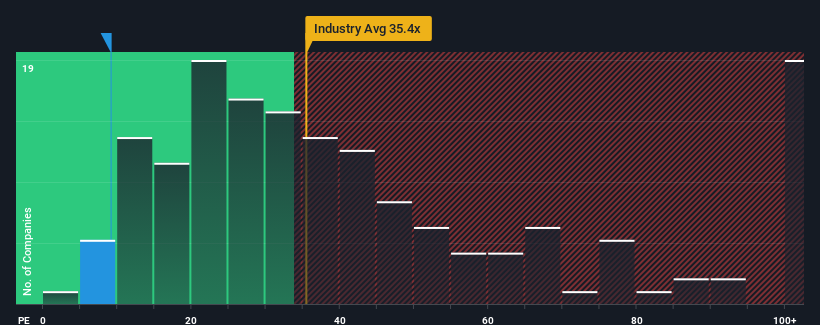

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 35x, you may consider Guizhou Tyre Co.,Ltd. (SZSE:000589) as a highly attractive investment with its 9.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Guizhou TyreLtd has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Guizhou TyreLtd

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Guizhou TyreLtd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 122% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 59% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 10% during the coming year according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 44%.

With this information, we are not surprised that Guizhou TyreLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guizhou TyreLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Guizhou TyreLtd that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.