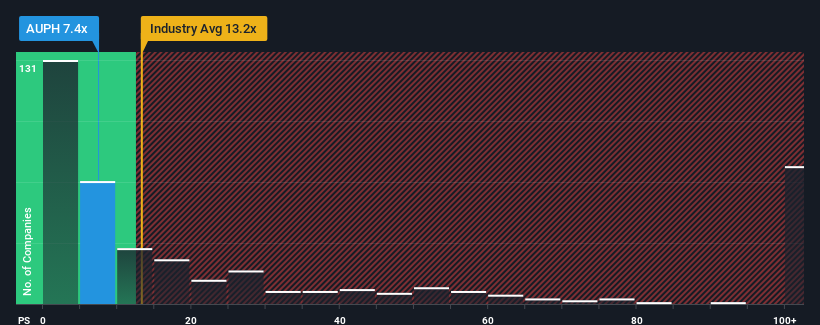

Aurinia Pharmaceuticals Inc.'s (NASDAQ:AUPH) price-to-sales (or "P/S") ratio of 7.4x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 13.2x and even P/S above 55x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Aurinia Pharmaceuticals

How Has Aurinia Pharmaceuticals Performed Recently?

With revenue growth that's inferior to most other companies of late, Aurinia Pharmaceuticals has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Aurinia Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Aurinia Pharmaceuticals' is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Aurinia Pharmaceuticals' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 33% per year during the coming three years according to the nine analysts following the company. That's shaping up to be materially lower than the 242% each year growth forecast for the broader industry.

With this information, we can see why Aurinia Pharmaceuticals is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Aurinia Pharmaceuticals' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aurinia Pharmaceuticals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Aurinia Pharmaceuticals with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.