The Bohai Automotive Systems CO., LTD. (SHSE:600960) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 11% in the last year.

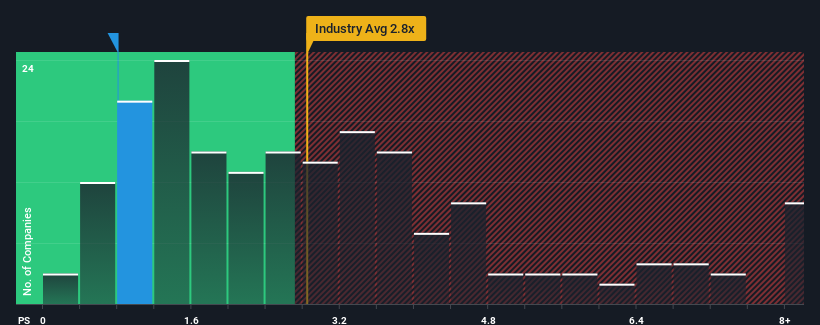

Since its price has dipped substantially, Bohai Automotive Systems' price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Auto Components industry in China, where around half of the companies have P/S ratios above 2.8x and even P/S above 5x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bohai Automotive Systems

What Does Bohai Automotive Systems' P/S Mean For Shareholders?

Bohai Automotive Systems has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Bohai Automotive Systems will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Bohai Automotive Systems has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Bohai Automotive Systems will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Bohai Automotive Systems would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 27% shows it's an unpleasant look.

With this in mind, we understand why Bohai Automotive Systems' P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Bohai Automotive Systems' P/S Mean For Investors?

Having almost fallen off a cliff, Bohai Automotive Systems' share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Bohai Automotive Systems revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Bohai Automotive Systems you should be aware of.

If you're unsure about the strength of Bohai Automotive Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.