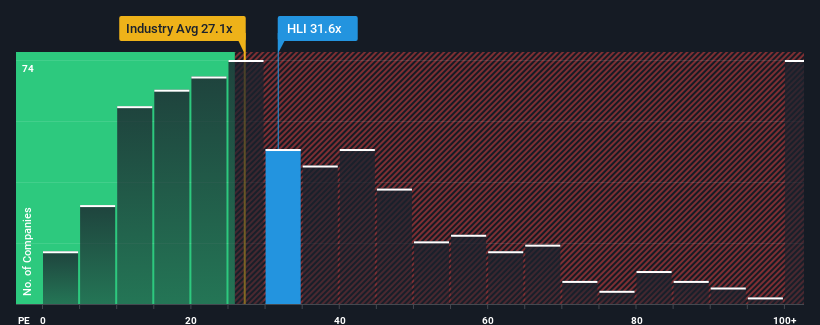

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Houlihan Lokey, Inc. (NYSE:HLI) as a stock to avoid entirely with its 31.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Houlihan Lokey as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Houlihan Lokey

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Houlihan Lokey's to be considered reasonable.

There's an inherent assumption that a company should far outperform the market for P/E ratios like Houlihan Lokey's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 32%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 14% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 14% per annum over the next three years. That's shaping up to be similar to the 13% per year growth forecast for the broader market.

In light of this, it's curious that Houlihan Lokey's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Houlihan Lokey's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Houlihan Lokey that you should be aware of.

If you're unsure about the strength of Houlihan Lokey's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.