Western Superconducting Technologies Co., Ltd. (SHSE:688122) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

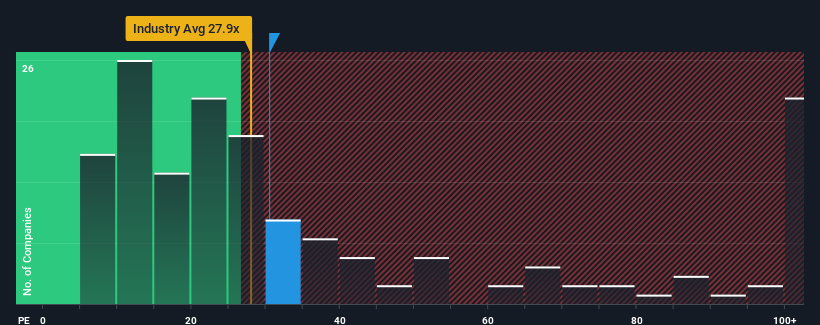

In spite of the heavy fall in price, it's still not a stretch to say that Western Superconducting Technologies' price-to-earnings (or "P/E") ratio of 30.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Western Superconducting Technologies has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Western Superconducting Technologies

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Western Superconducting Technologies' to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 136% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 46% during the coming year according to the five analysts following the company. Meanwhile, the rest of the market is forecast to expand by 43%, which is not materially different.

With this information, we can see why Western Superconducting Technologies is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Western Superconducting Technologies' plummeting stock price has brought its P/E right back to the rest of the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Western Superconducting Technologies' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Western Superconducting Technologies is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.