Shenzhen Tongyi Industry Co., Ltd. (SZSE:300538) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 32%, which is great even in a bull market.

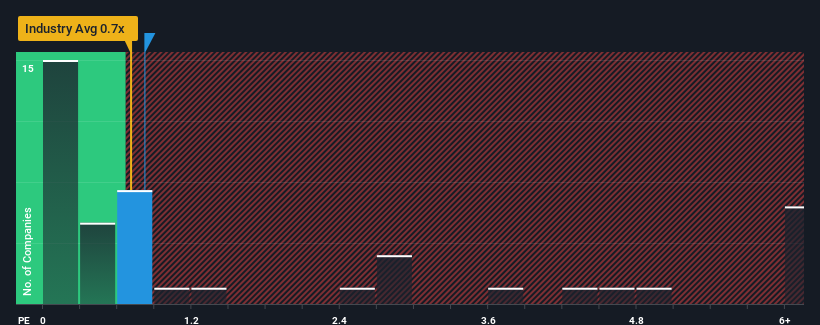

In spite of the heavy fall in price, there still wouldn't be many who think Shenzhen Tongyi Industry's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S in China's Trade Distributors industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Shenzhen Tongyi Industry

What Does Shenzhen Tongyi Industry's P/S Mean For Shareholders?

Revenue has risen firmly for Shenzhen Tongyi Industry recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Revenue has risen firmly for Shenzhen Tongyi Industry recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Tongyi Industry's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Pleasingly, revenue has also lifted 43% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 17% shows it's noticeably less attractive.

In light of this, it's curious that Shenzhen Tongyi Industry's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Shenzhen Tongyi Industry's P/S

Following Shenzhen Tongyi Industry's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Tongyi Industry revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 6 warning signs for Shenzhen Tongyi Industry you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.