Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Changjiang & Jinggong Steel Building (Group) Co., Ltd (SHSE:600496) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Changjiang & Jinggong Steel Building (Group)

What Is Changjiang & Jinggong Steel Building (Group)'s Debt?

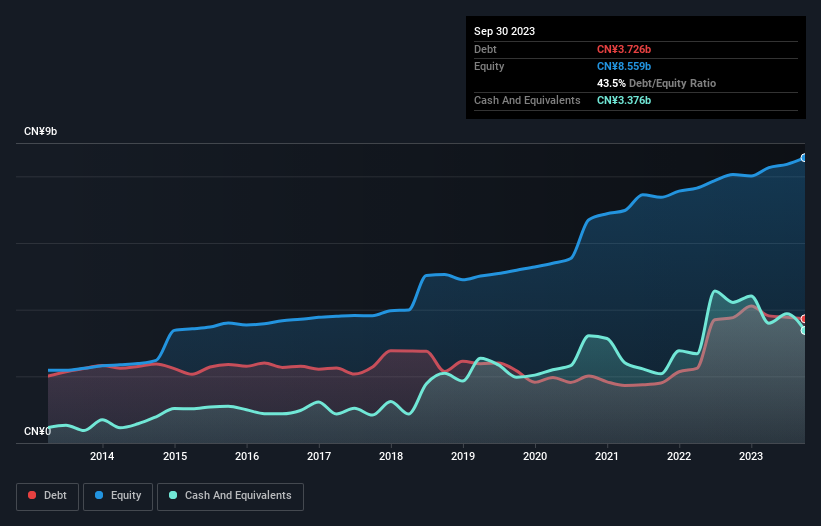

As you can see below, Changjiang & Jinggong Steel Building (Group) had CN¥3.73b of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have CN¥3.38b in cash offsetting this, leading to net debt of about CN¥350.2m.

How Strong Is Changjiang & Jinggong Steel Building (Group)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Changjiang & Jinggong Steel Building (Group) had liabilities of CN¥10.9b due within 12 months and liabilities of CN¥2.25b due beyond that. Offsetting this, it had CN¥3.38b in cash and CN¥11.0b in receivables that were due within 12 months. So it can boast CN¥1.22b more liquid assets than total liabilities.

This surplus suggests that Changjiang & Jinggong Steel Building (Group) is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Changjiang & Jinggong Steel Building (Group)'s net debt is only 0.46 times its EBITDA. And its EBIT covers its interest expense a whopping 16.1 times over. So we're pretty relaxed about its super-conservative use of debt. The modesty of its debt load may become crucial for Changjiang & Jinggong Steel Building (Group) if management cannot prevent a repeat of the 21% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Changjiang & Jinggong Steel Building (Group)'s ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Changjiang & Jinggong Steel Building (Group) burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

We weren't impressed with Changjiang & Jinggong Steel Building (Group)'s conversion of EBIT to free cash flow, and its EBIT growth rate made us cautious. But its interest cover was significantly redeeming. Looking at all this data makes us feel a little cautious about Changjiang & Jinggong Steel Building (Group)'s debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Changjiang & Jinggong Steel Building (Group) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.