The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by Fujian Rongji Software Co., Ltd. (SZSE:002474) shareholders over the last year, as the share price declined 45%. That contrasts poorly with the market decline of 21%. Longer term investors have fared much better, since the share price is up 4.4% in three years. The falls have accelerated recently, with the share price down 20% in the last three months. But this could be related to the weak market, which is down 9.2% in the same period.

After losing 9.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Fujian Rongji Software

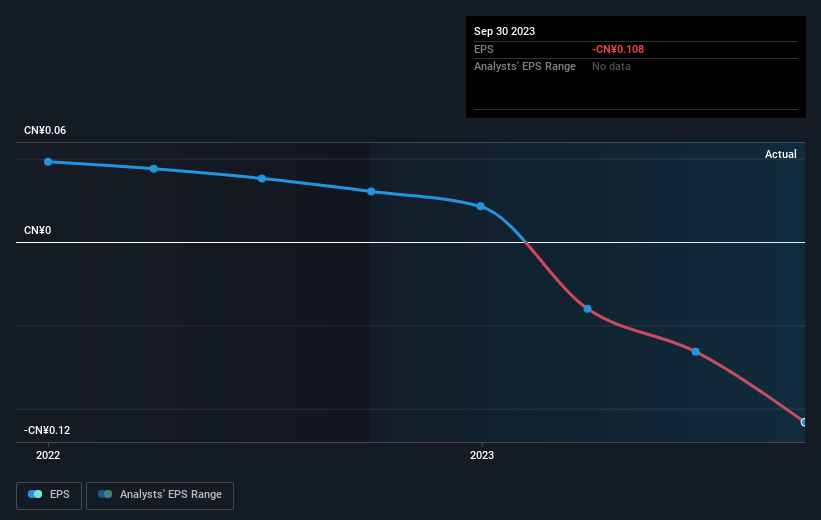

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Fujian Rongji Software fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. However, there may be an opportunity for investors if the company can recover.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While the broader market lost about 21% in the twelve months, Fujian Rongji Software shareholders did even worse, losing 45%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Fujian Rongji Software better, we need to consider many other factors. Take risks, for example - Fujian Rongji Software has 1 warning sign we think you should be aware of.

But note: Fujian Rongji Software may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.