What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Anhui Gourgen Traffic ConstructionLtd (SHSE:603815) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Anhui Gourgen Traffic ConstructionLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

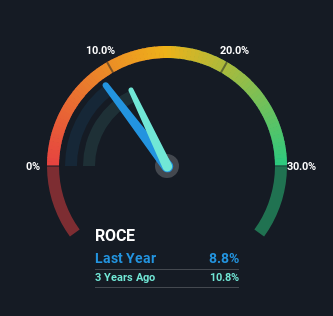

0.088 = CN¥312m ÷ (CN¥10b - CN¥6.7b) (Based on the trailing twelve months to September 2023).

Therefore, Anhui Gourgen Traffic ConstructionLtd has an ROCE of 8.8%. On its own that's a low return, but compared to the average of 6.8% generated by the Construction industry, it's much better.

Check out our latest analysis for Anhui Gourgen Traffic ConstructionLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Anhui Gourgen Traffic ConstructionLtd's past further, check out this free graph of past earnings, revenue and cash flow.

The Trend Of ROCE

Unfortunately, the trend isn't great with ROCE falling from 20% five years ago, while capital employed has grown 335%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Anhui Gourgen Traffic ConstructionLtd's earnings and if they change as a result from the capital raise. It's also worth noting the company's latest EBIT figure is within 10% of the previous year, so it's fair to assign the ROCE drop largely to the capital raise.

On a related note, Anhui Gourgen Traffic ConstructionLtd has decreased its current liabilities to 65% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money. Keep in mind 65% is still pretty high, so those risks are still somewhat prevalent.

Our Take On Anhui Gourgen Traffic ConstructionLtd's ROCE

In summary, we're somewhat concerned by Anhui Gourgen Traffic ConstructionLtd's diminishing returns on increasing amounts of capital. It should come as no surprise then that the stock has fallen 24% over the last three years, so it looks like investors are recognizing these changes. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

Anhui Gourgen Traffic ConstructionLtd does have some risks though, and we've spotted 1 warning sign for Anhui Gourgen Traffic ConstructionLtd that you might be interested in.

While Anhui Gourgen Traffic ConstructionLtd may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.