China Cyts Tours Holding Co., Ltd. (SHSE:600138) shareholders should be happy to see the share price up 12% in the last month. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 29% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for China Cyts Tours Holding

Given that China Cyts Tours Holding only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Given that China Cyts Tours Holding only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last twelve months, China Cyts Tours Holding increased its revenue by 15%. We think that is pretty nice growth. Meanwhile, the share price is down 29% over twelve months, which is disappointing given the progress made. You might even wonder if the share price was previously over-hyped. However, that's in the past now, and it's the future that matters most.

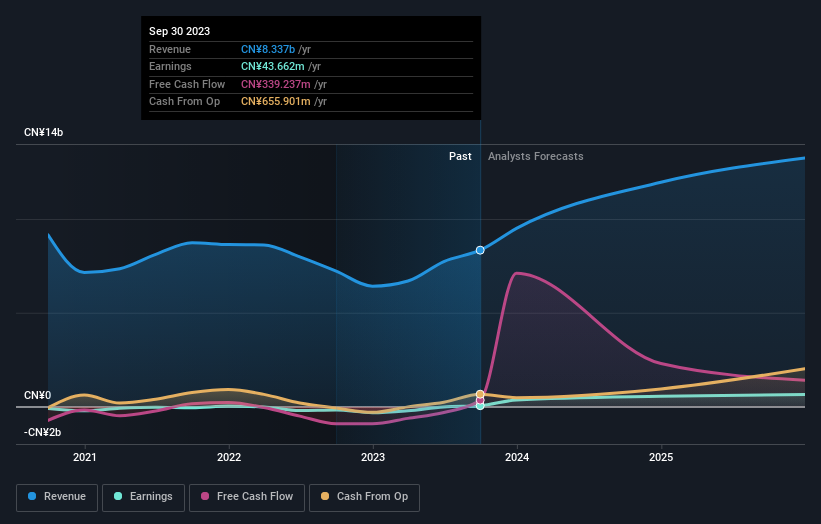

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that China Cyts Tours Holding has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that China Cyts Tours Holding shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand China Cyts Tours Holding better, we need to consider many other factors. For example, we've discovered 2 warning signs for China Cyts Tours Holding (1 is concerning!) that you should be aware of before investing here.

We will like China Cyts Tours Holding better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.