Investors in Murphy Oil Corporation (NYSE:MUR) had a good week, as its shares rose 2.1% to close at US$38.56 following the release of its full-year results. It looks like the results were a bit of a negative overall. While revenues of US$3.4b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 6.8% to hit US$4.22 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Murphy Oil

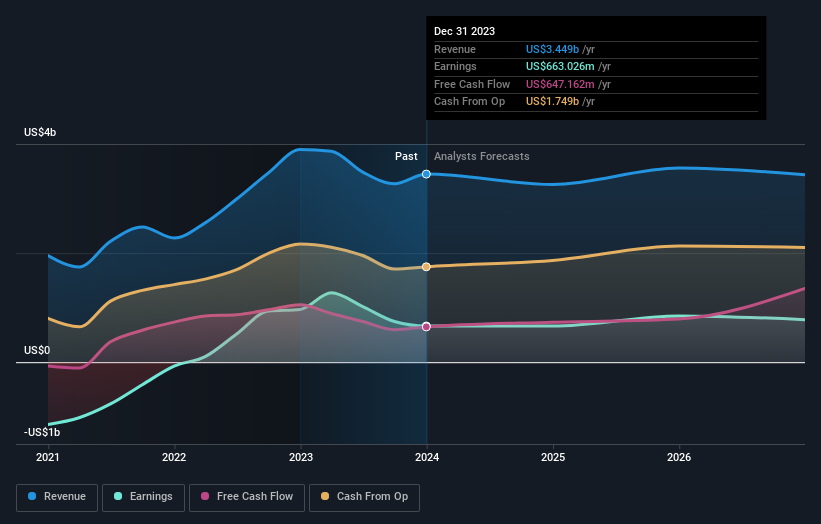

Taking into account the latest results, the current consensus, from the ten analysts covering Murphy Oil, is for revenues of US$3.26b in 2024. This implies a discernible 5.5% reduction in Murphy Oil's revenue over the past 12 months. Statutory per-share earnings are expected to be US$4.26, roughly flat on the last 12 months. Before this earnings report, the analysts had been forecasting revenues of US$3.42b and earnings per share (EPS) of US$4.88 in 2024. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a substantial drop in earnings per share estimates.

The analysts made no major changes to their price target of US$46.76, suggesting the downgrades are not expected to have a long-term impact on Murphy Oil's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Murphy Oil, with the most bullish analyst valuing it at US$60.00 and the most bearish at US$33.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

The analysts made no major changes to their price target of US$46.76, suggesting the downgrades are not expected to have a long-term impact on Murphy Oil's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Murphy Oil, with the most bullish analyst valuing it at US$60.00 and the most bearish at US$33.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that revenue is expected to slow, with a forecast annualised decline of 5.5% by the end of 2024. This indicates a significant reduction from annual growth of 12% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 0.09% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Murphy Oil is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. The consensus price target held steady at US$46.76, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Murphy Oil analysts - going out to 2026, and you can see them free on our platform here.

Even so, be aware that Murphy Oil is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.