Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term YiChang HEC ChangJiang Pharmaceutical Co., Ltd. (HKG:1558) shareholders for doubting their decision to hold, with the stock down 48% over a half decade. Even worse, it's down 12% in about a month, which isn't fun at all.

Since YiChang HEC ChangJiang Pharmaceutical has shed HK$431m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for YiChang HEC ChangJiang Pharmaceutical

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

YiChang HEC ChangJiang Pharmaceutical became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 3.2% per year is viewed as evidence that YiChang HEC ChangJiang Pharmaceutical is shrinking. This has probably encouraged some shareholders to sell down the stock.

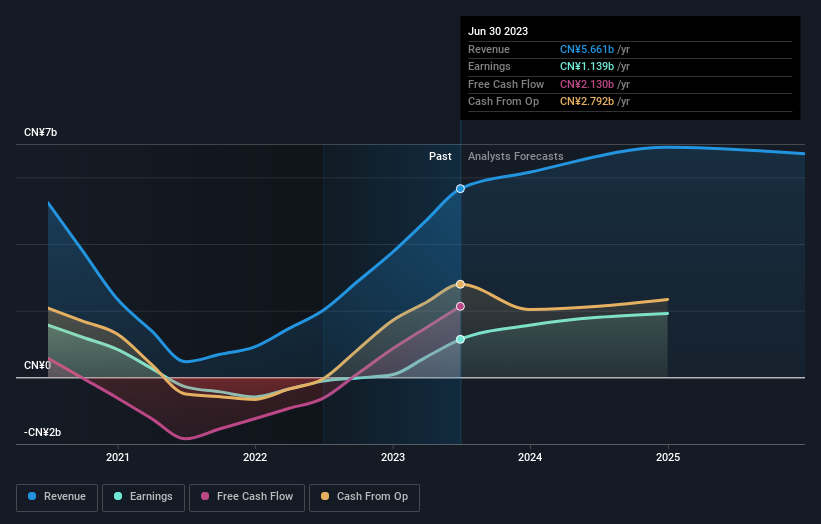

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think YiChang HEC ChangJiang Pharmaceutical will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We've already covered YiChang HEC ChangJiang Pharmaceutical's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. YiChang HEC ChangJiang Pharmaceutical's TSR of was a loss of 45% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that YiChang HEC ChangJiang Pharmaceutical shareholders have received a total shareholder return of 14% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before forming an opinion on YiChang HEC ChangJiang Pharmaceutical you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.