Unfortunately for some shareholders, the Genew Technologies Co.,Ltd. (SHSE:688418) share price has dived 30% in the last thirty days, prolonging recent pain. Indeed, the recent drop has reduced its annual gain to a relatively sedate 7.4% over the last twelve months.

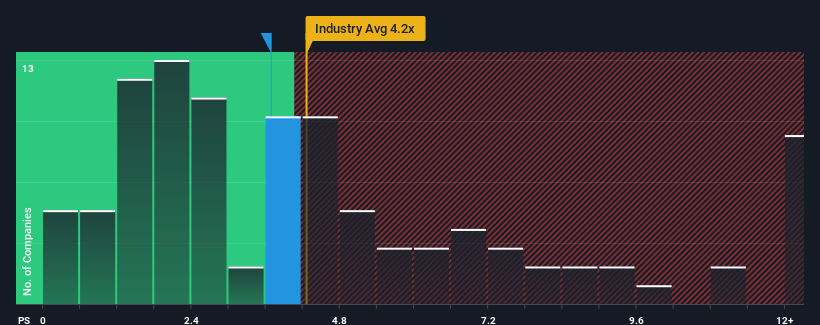

Although its price has dipped substantially, it's still not a stretch to say that Genew TechnologiesLtd's price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Communications industry in China, where the median P/S ratio is around 4.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Genew TechnologiesLtd

What Does Genew TechnologiesLtd's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Genew TechnologiesLtd has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

With its revenue growth in positive territory compared to the declining revenue of most other companies, Genew TechnologiesLtd has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Is There Some Revenue Growth Forecasted For Genew TechnologiesLtd?

The only time you'd be comfortable seeing a P/S like Genew TechnologiesLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. The latest three year period has also seen an excellent 43% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 108% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 43% growth forecast for the broader industry.

With this information, we find it interesting that Genew TechnologiesLtd is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Genew TechnologiesLtd's P/S?

Genew TechnologiesLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Genew TechnologiesLtd's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Genew TechnologiesLtd (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.