Guangdong Ganhua Science & Industry Co., Ltd. (SZSE:000576) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

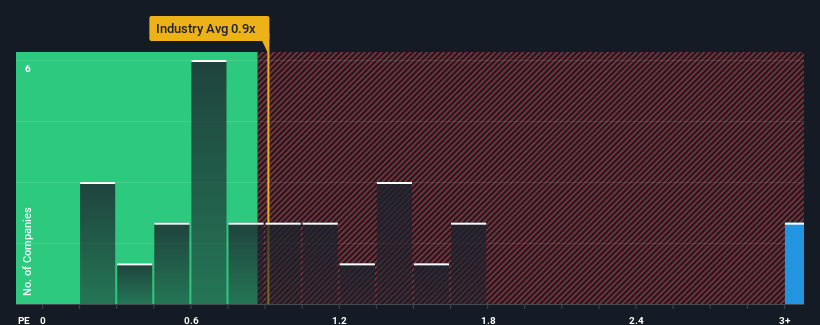

Although its price has dipped substantially, given around half the companies in China's Consumer Retailing industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Guangdong Ganhua Science & Industry as a stock to avoid entirely with its 6.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Guangdong Ganhua Science & Industry

What Does Guangdong Ganhua Science & Industry's P/S Mean For Shareholders?

Revenue has risen firmly for Guangdong Ganhua Science & Industry recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Revenue has risen firmly for Guangdong Ganhua Science & Industry recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Is There Enough Revenue Growth Forecasted For Guangdong Ganhua Science & Industry?

Guangdong Ganhua Science & Industry's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 5.4% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's an unpleasant look.

With this in mind, we find it worrying that Guangdong Ganhua Science & Industry's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Guangdong Ganhua Science & Industry's P/S Mean For Investors?

A significant share price dive has done very little to deflate Guangdong Ganhua Science & Industry's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Guangdong Ganhua Science & Industry revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Guangdong Ganhua Science & Industry with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.