To the annoyance of some shareholders, Shenzhen Longsys Electronics Co., Ltd. (SZSE:301308) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

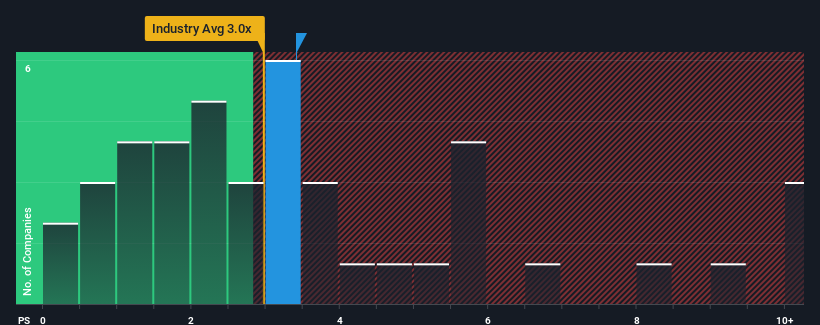

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Shenzhen Longsys Electronics' P/S ratio of 3.4x, since the median price-to-sales (or "P/S") ratio for the Tech industry in China is also close to 3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Shenzhen Longsys Electronics

What Does Shenzhen Longsys Electronics' P/S Mean For Shareholders?

Shenzhen Longsys Electronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Shenzhen Longsys Electronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Shenzhen Longsys Electronics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 38% as estimated by the six analysts watching the company. With the industry only predicted to deliver 28%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Shenzhen Longsys Electronics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Shenzhen Longsys Electronics' P/S?

Following Shenzhen Longsys Electronics' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenzhen Longsys Electronics currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shenzhen Longsys Electronics with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.