Chongqing Sanxia Paints Co., Ltd (SZSE:000565) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

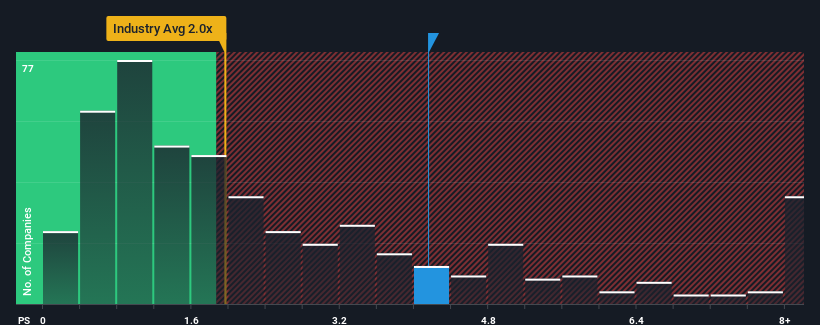

Although its price has dipped substantially, you could still be forgiven for thinking Chongqing Sanxia Paints is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in China's Chemicals industry have P/S ratios below 2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Chongqing Sanxia Paints' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Chongqing Sanxia Paints, which is generally not a bad outcome. It might be that many expect the reasonable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Chongqing Sanxia Paints will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Chongqing Sanxia Paints?

In order to justify its P/S ratio, Chongqing Sanxia Paints would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Chongqing Sanxia Paints would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.0% last year. The solid recent performance means it was also able to grow revenue by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in mind, we find it worrying that Chongqing Sanxia Paints' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Chongqing Sanxia Paints' P/S Mean For Investors?

Chongqing Sanxia Paints' shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Chongqing Sanxia Paints revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It is also worth noting that we have found 1 warning sign for Chongqing Sanxia Paints that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.