The Guangdong Dcenti Auto-Parts Stock Limited Company (SHSE:603335) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

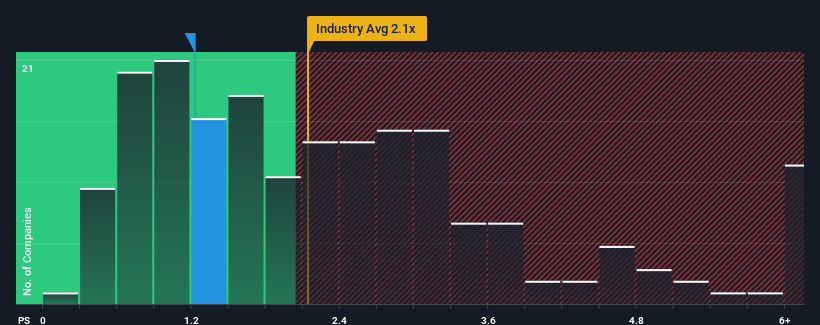

After such a large drop in price, when close to half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider Guangdong Dcenti Auto-Parts Stock Limited as an enticing stock to check out with its 1.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Guangdong Dcenti Auto-Parts Stock Limited Has Been Performing

Revenue has risen at a steady rate over the last year for Guangdong Dcenti Auto-Parts Stock Limited, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guangdong Dcenti Auto-Parts Stock Limited will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Guangdong Dcenti Auto-Parts Stock Limited would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Guangdong Dcenti Auto-Parts Stock Limited would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 5.2% gain to the company's revenues. The latest three year period has also seen an excellent 88% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 25% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Guangdong Dcenti Auto-Parts Stock Limited's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Guangdong Dcenti Auto-Parts Stock Limited's P/S?

Guangdong Dcenti Auto-Parts Stock Limited's recently weak share price has pulled its P/S back below other Auto Components companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Guangdong Dcenti Auto-Parts Stock Limited currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

Having said that, be aware Guangdong Dcenti Auto-Parts Stock Limited is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.