Gansu Yatai Industrial Developent Co.,Ltd. (SZSE:000691) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 25% share price drop.

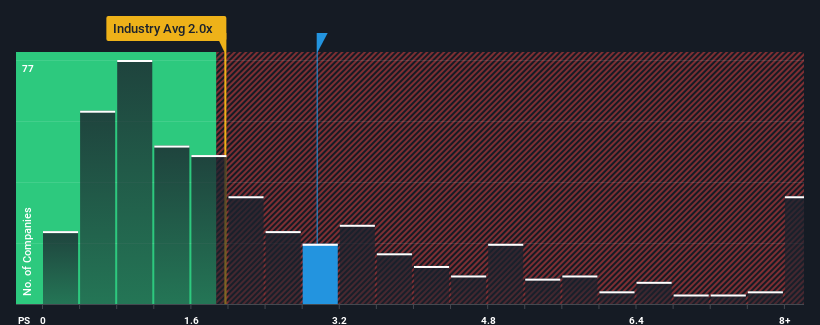

Even after such a large drop in price, when almost half of the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 2x, you may still consider Gansu Yatai Industrial DevelopentLtd as a stock probably not worth researching with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Gansu Yatai Industrial DevelopentLtd's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Gansu Yatai Industrial DevelopentLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Gansu Yatai Industrial DevelopentLtd will help you shine a light on its historical performance.How Is Gansu Yatai Industrial DevelopentLtd's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Gansu Yatai Industrial DevelopentLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. Even so, admirably revenue has lifted 136% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 27% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Gansu Yatai Industrial DevelopentLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Gansu Yatai Industrial DevelopentLtd's P/S?

There's still some elevation in Gansu Yatai Industrial DevelopentLtd's P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Gansu Yatai Industrial DevelopentLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Gansu Yatai Industrial DevelopentLtd has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Gansu Yatai Industrial DevelopentLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.