The Shenzhen GuoHua Network Security Technology Co., Ltd. (SZSE:000004) share price has fared very poorly over the last month, falling by a substantial 26%. Longer-term, the stock has been solid despite a difficult 30 days, gaining 18% in the last year.

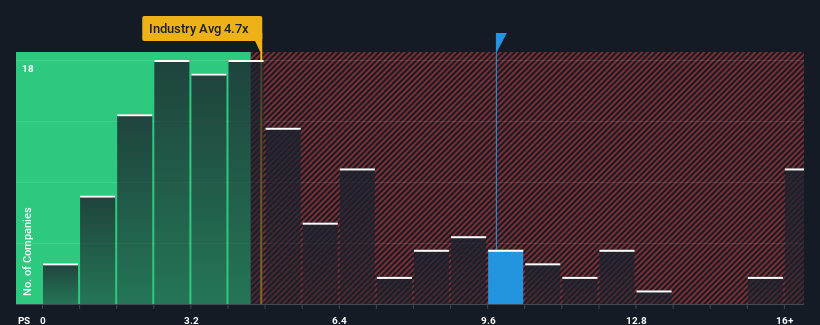

Even after such a large drop in price, Shenzhen GuoHua Network Security Technology may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.8x, when you consider almost half of the companies in the Software industry in China have P/S ratios under 4.7x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Shenzhen GuoHua Network Security Technology Performed Recently?

For example, consider that Shenzhen GuoHua Network Security Technology's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shenzhen GuoHua Network Security Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Shenzhen GuoHua Network Security Technology?

Shenzhen GuoHua Network Security Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Shenzhen GuoHua Network Security Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 35% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Shenzhen GuoHua Network Security Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Shenzhen GuoHua Network Security Technology's P/S

Shenzhen GuoHua Network Security Technology's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Shenzhen GuoHua Network Security Technology currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Shenzhen GuoHua Network Security Technology (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.