BeijingABT Networks Co.,Ltd. (SHSE:688168) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

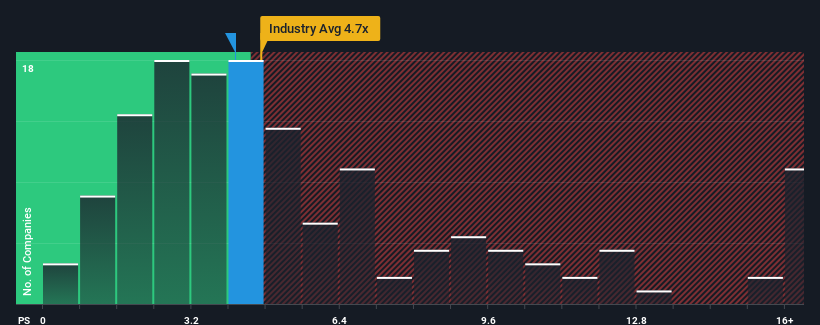

Even after such a large drop in price, there still wouldn't be many who think BeijingABT NetworksLtd's price-to-sales (or "P/S") ratio of 4.1x is worth a mention when the median P/S in China's Software industry is similar at about 4.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does BeijingABT NetworksLtd's P/S Mean For Shareholders?

Revenue has risen firmly for BeijingABT NetworksLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on BeijingABT NetworksLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for BeijingABT NetworksLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For BeijingABT NetworksLtd?

The only time you'd be comfortable seeing a P/S like BeijingABT NetworksLtd's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like BeijingABT NetworksLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.1% last year. Pleasingly, revenue has also lifted 92% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 35% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that BeijingABT NetworksLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On BeijingABT NetworksLtd's P/S

With its share price dropping off a cliff, the P/S for BeijingABT NetworksLtd looks to be in line with the rest of the Software industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BeijingABT NetworksLtd's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BeijingABT NetworksLtd (at least 1 which is significant), and understanding these should be part of your investment process.

If you're unsure about the strength of BeijingABT NetworksLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.