DuoLun Technology Corporation Ltd. (SHSE:603528) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 12% share price drop.

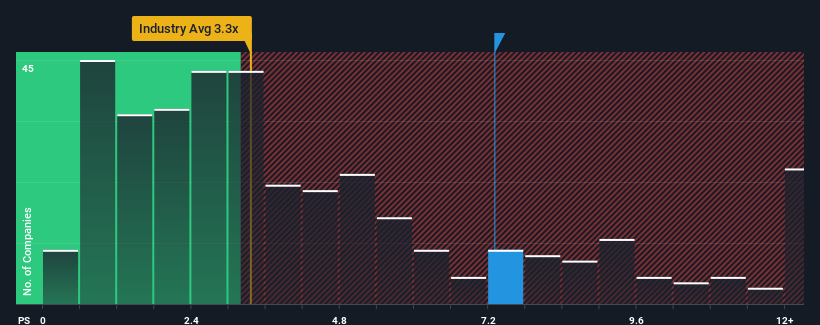

Although its price has dipped substantially, you could still be forgiven for thinking DuoLun Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 7.3x, considering almost half the companies in China's Electronic industry have P/S ratios below 3.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

How DuoLun Technology Has Been Performing

DuoLun Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DuoLun Technology.How Is DuoLun Technology's Revenue Growth Trending?

In order to justify its P/S ratio, DuoLun Technology would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, DuoLun Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.2%. The last three years don't look nice either as the company has shrunk revenue by 1.9% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 58% during the coming year according to the one analyst following the company. With the industry predicted to deliver 61% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that DuoLun Technology is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

DuoLun Technology's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting DuoLun Technology's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 4 warning signs for DuoLun Technology (2 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of DuoLun Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.