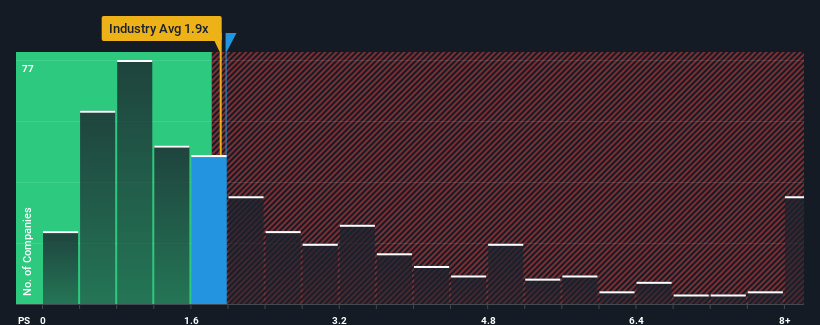

It's not a stretch to say that Tianyang New Materials (Shanghai) Technology Co., Ltd.'s (SHSE:603330) price-to-sales (or "P/S") ratio of 2x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in China, where the median P/S ratio is around 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Tianyang New Materials (Shanghai) Technology's P/S Mean For Shareholders?

Tianyang New Materials (Shanghai) Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tianyang New Materials (Shanghai) Technology.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Tianyang New Materials (Shanghai) Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. Even so, admirably revenue has lifted 114% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's top line. Even so, admirably revenue has lifted 114% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 104% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Tianyang New Materials (Shanghai) Technology is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Tianyang New Materials (Shanghai) Technology's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Tianyang New Materials (Shanghai) Technology you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.