It's easy to feel disappointed if you buy a stock that goes down. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. Over the year the Sunvim Group Co.,Ltd (SZSE:002083) share price fell 21%. However, that's better than the market's overall decline of 25%. Longer term investors have fared much better, since the share price is up 6.1% in three years. More recently, the share price has dropped a further 17% in a month. We do note, however, that the broader market is down 13% in that period, and this may have weighed on the share price.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

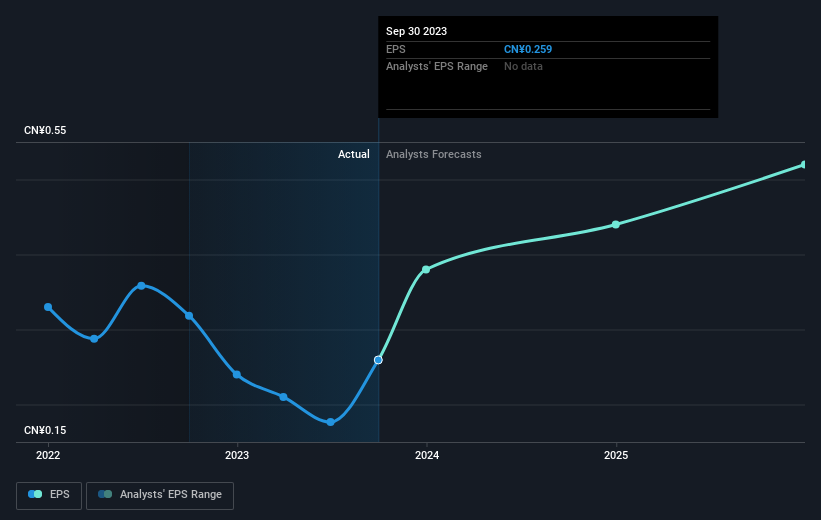

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Sunvim GroupLtd reported an EPS drop of 19% for the last year. This proportional reduction in earnings per share isn't far from the 21% decrease in the share price. Therefore one could posit that the market has not become more concerned about the company, despite the lower EPS. Rather, the share price is remains a similar multiple of the EPS, suggesting the outlook remains the same.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Sunvim GroupLtd's key metrics by checking this interactive graph of Sunvim GroupLtd's earnings, revenue and cash flow.

A Different Perspective

Although it hurts that Sunvim GroupLtd returned a loss of 21% in the last twelve months, the broader market was actually worse, returning a loss of 25%. Given the total loss of 2% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Sunvim GroupLtd that you should be aware of before investing here.

We will like Sunvim GroupLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.