Jiangsu Boxin Investing&Holdings Co.,Ltd. (SHSE:600083) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

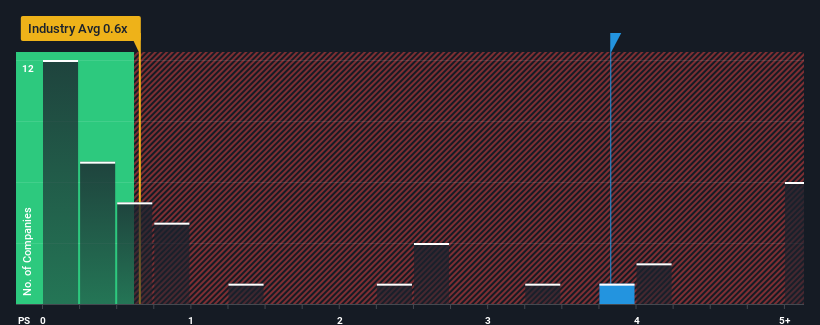

Even after such a large drop in price, you could still be forgiven for thinking Jiangsu Boxin Investing&HoldingsLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in China's Trade Distributors industry have P/S ratios below 0.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Jiangsu Boxin Investing&HoldingsLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Jiangsu Boxin Investing&HoldingsLtd over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Boxin Investing&HoldingsLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Jiangsu Boxin Investing&HoldingsLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Boxin Investing&HoldingsLtd's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Jiangsu Boxin Investing&HoldingsLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

A significant share price dive has done very little to deflate Jiangsu Boxin Investing&HoldingsLtd's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Jiangsu Boxin Investing&HoldingsLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Jiangsu Boxin Investing&HoldingsLtd.

If these risks are making you reconsider your opinion on Jiangsu Boxin Investing&HoldingsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.