Shenzhen King Explorer Science and Technology Corporation (SZSE:002917) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

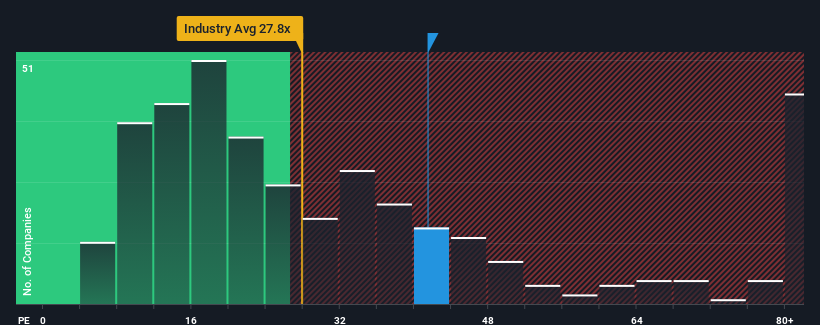

Even after such a large drop in price, Shenzhen King Explorer Science and Technology may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 41.5x, since almost half of all companies in China have P/E ratios under 27x and even P/E's lower than 17x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Shenzhen King Explorer Science and Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Shenzhen King Explorer Science and Technology would need to produce impressive growth in excess of the market.

In order to justify its P/E ratio, Shenzhen King Explorer Science and Technology would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 34% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 204% over the next year. Meanwhile, the rest of the market is forecast to only expand by 41%, which is noticeably less attractive.

With this information, we can see why Shenzhen King Explorer Science and Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Shenzhen King Explorer Science and Technology's P/E?

Shenzhen King Explorer Science and Technology's P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shenzhen King Explorer Science and Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Shenzhen King Explorer Science and Technology that we have uncovered.

Of course, you might also be able to find a better stock than Shenzhen King Explorer Science and Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.