The Hangzhou Shunwang Technology Co,Ltd (SZSE:300113) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

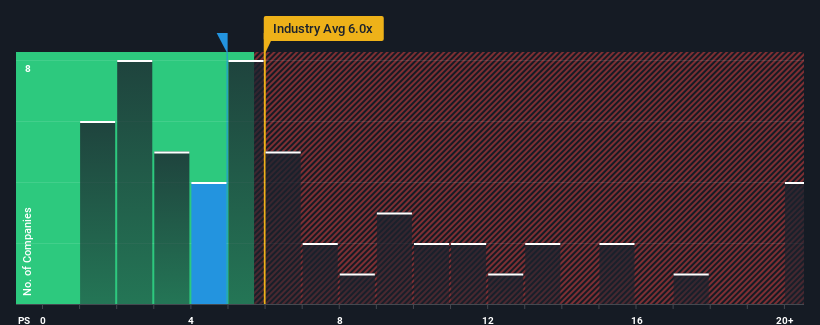

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Hangzhou Shunwang Technology CoLtd's P/S ratio of 4.9x, since the median price-to-sales (or "P/S") ratio for the Entertainment industry in China is also close to 6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Hangzhou Shunwang Technology CoLtd Has Been Performing

Hangzhou Shunwang Technology CoLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Hangzhou Shunwang Technology CoLtd's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hangzhou Shunwang Technology CoLtd's to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hangzhou Shunwang Technology CoLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The latest three year period has also seen a 22% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 20% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 36% growth forecast for the broader industry.

With this in mind, we find it intriguing that Hangzhou Shunwang Technology CoLtd's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Hangzhou Shunwang Technology CoLtd's P/S?

Hangzhou Shunwang Technology CoLtd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Hangzhou Shunwang Technology CoLtd's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Hangzhou Shunwang Technology CoLtd with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.