The Ningbo Jintian Copper (Group) Co., Ltd. (SHSE:601609) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 30% share price drop.

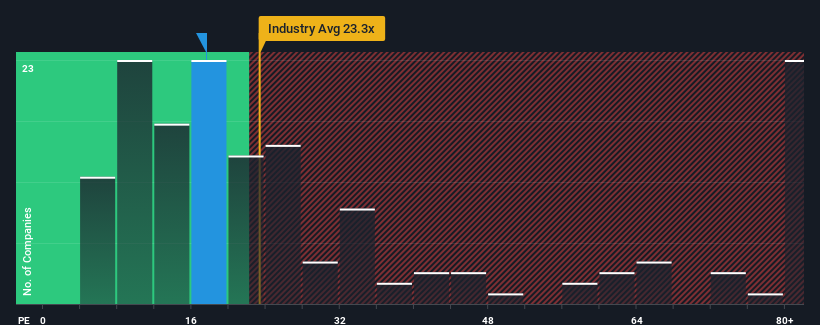

After such a large drop in price, Ningbo Jintian Copper (Group)'s price-to-earnings (or "P/E") ratio of 17.6x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 27x and even P/E's above 48x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Ningbo Jintian Copper (Group) has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Ningbo Jintian Copper (Group) would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Ningbo Jintian Copper (Group) would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. As a result, earnings from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 106% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's peculiar that Ningbo Jintian Copper (Group)'s P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Ningbo Jintian Copper (Group)'s P/E?

The softening of Ningbo Jintian Copper (Group)'s shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Ningbo Jintian Copper (Group)'s analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Ningbo Jintian Copper (Group) (of which 1 doesn't sit too well with us!) you should know about.

You might be able to find a better investment than Ningbo Jintian Copper (Group). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.